Apartment rents across Australia have increased six times faster than wages and house rents have climbed at triple the rate, leaving many tenants struggling to make ends meet.

Median weekly asking rents for apartments in the capital cities rose 22.2 per cent over the year to March, Domain data shows, while wages rose just 3.7 per cent over the year, the latest figures from the Australian Bureau of Statistics show.

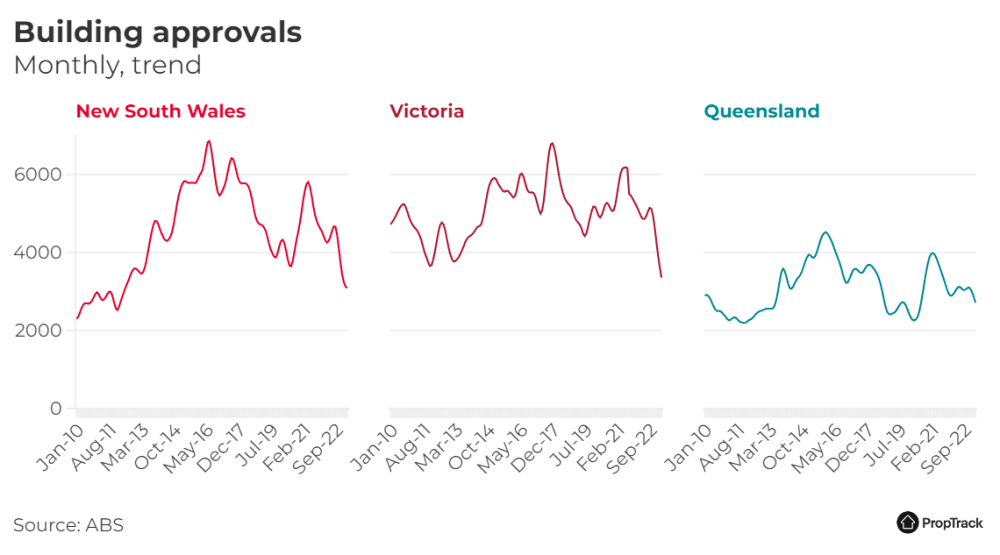

Annual growth in rents vs wages – houses

Unit rents increased more than six times faster in Sydney and Melbourne, where the medians jumped by 24 per cent and 23.1 per cent respectively, to $620 and $480 per week. Median house rents rose 13 per cent across the combined capital cities. Perth had the largest increase at 14.6 per cent, while asking rents rose 10 per cent in Sydney, 11.1 per cent in Melbourne and 12 per cent in Brisbane.

Westpac senior economist Matthew Hassan said Australian tenants were facing strong competition for homes. Returning migration was adding to already strong demand, amid a time of lower supply – due to a drop in homes being built and some investors cashing out of the market during the boom. Rents had climbed rapidly as a result, particularly in inner Melbourne and Sydney where they skyrocketed 40 per cent and 29.3 per cent respectively over the year, rebounding from sharp declines earlier in the pandemic.

“I think the initial jump in rents was a catch-up from COVID, but it’s now gone beyond that,” Hassan said.

A decrease in household sizes earlier in the pandemic, as tenants sought more space, was likely to be reversed as a result, Hassan said.

“Now we’re going back to the pre-existing trend [of people moving back home, or share-housing to afford rent],” he said, adding more households could look to take on boarders, as was common in the 1950s and 1960s as a solution to the rising costs of mortgages.

Median income households now need to spend almost a third of their pay (30.8 per cent) on rent for a new lease, the highest level since 2014, the recent ANZ CoreLogic Housing Affordability Report showed. This climbs to 51.6 per cent for lower income households. Hassan said the market was extremely tough for those on lower incomes, and noted the longer rents outpaced incomes, the harder it would become.

“It’s pretty bleak. It doesn’t seem anything in the short term will be improving that,” Hassan said.

Reserve Bank governor Philip Lowe told a Senate estimates hearing on Wednesday, that people may have to move back in with family or a flatmate to reduce their rent costs, after moving out during COVID-19.

“The higher prices lead people to economise on housing. That’s the price mechanism at work,” he said. “We need more people, on average to live in each dwelling.”

The sharp hikes have pushed more fortunate tenants such as Sydney marketing professional Ryan Wright to buy property. His landlord tried to hike the rent on his Waterloo apartment by $200 per week last year, and while he and his partner negotiated a smaller increase, they knew further rises were likely. Unit rents in the suburbs lifted 21 per cent over the year to March.

“We were paying $875 per week, but then the landlord tried to raise the rent to more than $1000. We negotiated a $75 per week rise.

“The laws mean landlords can only raise the rent every 12 months, so when the lease expired in March, we decided to buy because the repayments on our home loan are less than $1100 per week.”

That is cheaper than some advertised rents for two and three-bedroom apartments in the suburb, Wright said.

“We’re in a very privileged position because we can afford to buy, but there are so many people just being pushed out because they can’t afford the rent increases,” Wright said.

Barry Plant Melbourne executive director Mike McCarthy said tenants were making tough decisions about where and what they are renting.

“It’s like the stress we have seen for people purchasing a home who have had to readjust their budgets as interest rates rise, we’re now seeing that phenomenon extend to the rental market,” McCarthy said.

“People are changing the type of property they want to rent and changing it to a less expensive property like a townhouse or an apartment,” he said.

Anglicare Australia acting executive director Maiy Azize said a growing number of working Australians were unable to afford their rent and rising living costs.

“Rents have been surging for years … [and] wages are not keeping up,” she said.

Fewer available rentals is adding pressure to a tight market. Photo: Flavio Brancaleone

The situation was worse for those on the pension or other support payments, she said. More people were sleeping rough, and homelessness services were having to turn away one in three people in need.

“Some people are couch-surfing for months at a time or sleeping in cars,” she said.

“Even average people who are working are finding themselves in rentals they just can’t afford, and they’re not sleeping rough, but they’re being completely wiped out [financially by rent increases].”

Azize said more social and affordable housing was desperately needed to help address the crisis, and payments such as JobSeeker and Youth Allowance needed to be increased.

Source: Domain.com.au