New data has revealed that four out of five borrowers have had to tighten their budgets to keep up with home loan repayments as a result of high interest rates.

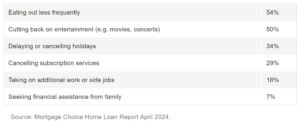

In the latest Mortgage Choice Home Loan Report, more than half of customers questioned said they were eating out less frequently and had also cut back on entertainment expenses, such as going to the cinema or concerts.

Interest rates have risen 13 times since May 2022, significantly increasing home loan repayments and stretching homeowners’ budgets.

As a result, homeowners have seen their mortgage repayments increase by hundreds or even thousands of dollars each month.

Borrowers have found various ways to cut back on spending to meet their home loan obligations, including delaying or cancelling holidays and cancelling subscription services.

Some are finding it tougher than others, with almost one in five taking on extra work or side jobs to make additional money.

Sacrifices made by borrowers

It’s not just discretionary spending that borrowers have cut back on. One in five borrowers have dipped into their savings to make ends meet.

However, not everyone has funds set aside for emergencies, leaving 7% of borrowers asking family for financial assistance.

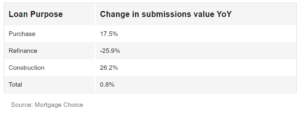

Despite many homeowners still struggling, the latest data shows that refinancing activity has slowed by almost 26% compared to the March quarter of last year.

This slowdown is due to the peak of inflation passing, the stability of the cash rate, and the fact that most homeowners who were looking to refinance have already done so.

Changes in loan purpose over March 2024 quarter

There are also signs of optimism from potential buyers who are increasingly confident that now is a good time to buy.

More than half of potential buyers had postponed their purchasing plans until 2024, but 70% now feel positive about buying, up from just 59% in May 2023.

This optimism is reflected in the latest Mortgage Choice home loan application data, which shows the value of purchase submissions increased by 17.5% compared to the previous March quarter.

With rising property prices, the average loan size has increased by 9% nationally.

Borrowers will continue to see their finances stretched until interest rates begin to decrease, although there are differing opinions on when the first rate cut will occur.

Nevertheless, with rising confidence that now is a good time to buy, potential buyers view the current market conditions as favourable or likely to improve soon.

As a result, we could see an increase in demand over the remainder of the year, particularly leading up to the spring selling season.

Source: realestate.com.au