The housing crisis continues to put pressure on many Australians, particularly renters, with typical rents up 9.1% over the past year.

But new data on construction across the country shows that rents have grown less – and even fallen – where more homes were built last year. This shows the importance of building more homes to solve the housing crisis.

Commitments by the federal and state governments to deliver more housing have been welcomed. But there remain doubts that enough homes can be built to ease conditions for renters in the near term.

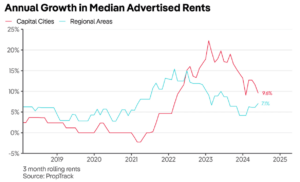

Rents continue to increase faster pace than incomes

After a long period of modest rental increases before the pandemic, pressures from changing preferences, smaller household sizes and volatile population growth have increased the demand for housing over the past two years.

At the same time, the pandemic disrupted supply chains and made building more homes difficult. This resulted in rapid rent growth, with capital city rents growing more than 10% per year for most of the time since early 2022, peaking at an annual pace of more than 20% in early 2023.

While the pace of rent increases has slowed since early 2023, typical rents in capital cities have still increased by 9.6% over the past year- far in excess of most people’s wage increases over the same period.

As a result, this has driven rental affordability across the country to its lowest level in at least 18 years.

Construction estimates show more building lowers rents

But there is hope for renters.

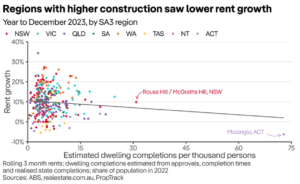

Over 2023, regions across the country where more homes completed construction saw slower rent growth, on average.

At the national level, the relationship between rent growth and recent construction has been quite weak – leading some to doubt that higher supply works to lower rents.

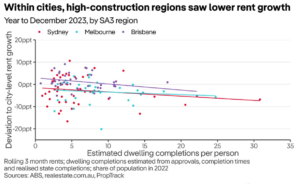

But on top of construction differences, each market is dealing with different demand (and supply) dynamics, so it is more appropriate to look at differences within regions.

For example, looking at regions in the largest cities of Sydney, Melbourne and Brisbane, we have seen a clear relationship where those regions with higher construction saw lower rent growth than the city-averages.

While the estimated effect over a short period like this is small – high-construction regions were associated with rent growth of just a couple of percentage points lower than average – it’s over a longer time horizon when you start to see the pronounced effect of lower housing costs.

Recent academic research has painstakingly documented both that new supply lowers rents (more supply overwhelms any impact of development to increase demand in a region from gentrification), and how the construction of new homes opens up the supply of existing homes for lower-income residents through chains of moving households.[1]

Crucially, the academic research accounts for the fact that construction is more likely to occur where demand is high and rents are rising quickly.

This effect means the above analysis likely understates the impact of construction on rents.

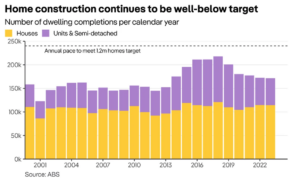

Despite being a policy focus, not enough homes are being built

It is pleasing then that the policy focus has been directed at building more homes.

State and Federal governments have agreed the solution to the housing crisis is increasing construction, with the National Cabinet setting an ambitious target to build 1.2 million well-located homes over the next five years.

But the number of homes built last year, just 170,000, is well-short of the 240,000 annual pace needed to hit this target.

New measures introduced in the 2024/25 Federal budget were aimed at alleviating constraints that have hampered the building industry.

But more needs to be done.

Councils across the country need to meet ambitious targets for new home construction aimed at ensuring long-run rent growth remains in line with wages. Penalties – rather than just rewards – should be considered for regions not doing their bit to enable land to be developed and unlock housing supply.

The evidence shows much more construction is needed to slow rents and ease the housing crisis for renters across the country.

Source: realestate.com.au