Each month the CoreLogic Research team puts together a Housing Chart Pack, with all the latest stats, facts and figures on the residential property market, such as the combined value of residential real estate, sales volumes, and the trend in rents.

- The value of residential real estate increased to an estimated $10.3 trillion at the end of November, up from $10.2 trillion in the previous month.

- Dwelling values across the combined capitals rose 0.6% in November. Monthly growth across the capital cities has broadly eased since recording a recent high of 1.5% in May.

- The growth trajectory for housing values across the combined capitals has slowed markedly through November. This was likely a reflection of higher interest rate settings, a rise in total listings volumes, and stretched affordability.

- Perth led capital growth performance in the greater capital city markets. In the year to November, Perth home values increased 13.5%. In the three months to November, Perth home values rose 5.4%.

- Adelaide, Brisbane and Perth home values are currently at a record high.

- In the 12 months to November, CoreLogic estimates there were 479,477 sales nationally. This is -7.6% lower than the sales volume to November 2022.

- Monthly sales volumes have generally trended higher through to the end of the year, and are above the historic five-year average monthly sales volume of 40,972.

- It is taking slightly longer to sell properties across Australia than in previous months. The median selling time has reduced across the combined capitals market year-on-year, but the trend looks to be turning as market conditions soften slightly.

- Vendor discounting vastly improved for sellers throughout 2023, in line with the reduction in selling times. However, across the capital cities the rate of vendor discounting now looks to be steadying at -3.3%.

- In the four weeks to December 3, new listings totalled 38,012 nationally. New listings have begun a seasonal slowdown, however it is clear that the flow of new listings got much closer to the historic five-year average during the second half of 2023.

- At the national level, there were 160,757 listings observed over the four weeks to December 3. Total listings are gradually lifting off the back of a substantial rise in new listings, but remain -17.7% below the historic five-year average.

- As with the capital growth trend, the final clearance rate across the combined capital cities market is currently trending lower.

- Dwelling approvals have begun to trend higher since a recent low in January 2023, but remain relatively low overall.

- Mortgage originations for ‘riskier’ types of lending continued to trend lower through the September quarter of 2023. The portion of loans originated with a debt-to-income ratio of six or more fell to 5.7% (down from a high of 24.3% in the December 2021 quarter).

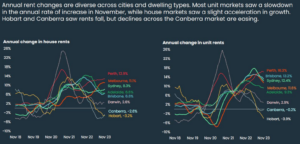

- The December ‘Chart of the Month’ has the rolling annual changes in house and unit rents across the capital city markets. Annual rent changes are diverse across cities and dwelling types. Most unit markets saw a slowdown in the annual rate of increase in November, while house markets saw a slight acceleration in growth.

CHART OF THE MONTH

Source: corelogic.com.au