When it comes to buying your dream home in 2023, the idea of ‘out with the old and in with the new’ has a lot going for it.

There are some very good reasons for this, ranging from lifestyle shifts to environmental benefits and unique market conditions.

Here are just six reasons why buying new over established could be just the thing for you in the year ahead.

1. Could be cheaper and easier

If you’ve been thinking about customising your home to your current needs, you’ll probably be weighing up whether it’s better to renovate or build new.

Renovating an established home can turn out to be a lot more costly, difficult and stressful then you anticipate. Your grand plans might end up being thwarted by limitations around old foundations, immovable frames or aging connections.

However, with a new build, you can choose the floorplan, features and stylings that suit your needs, explains Anne Flaherty, economist at realestate.com.au.

“Buying new gives you a greater level of control over the fit out of the property,” Flaherty says.

“When you move in, everything is already the way you want it, rather than purchasing and then having to renovate.”

New homes are more sustainable, lower maintenance and perfectly designed to meet modern lifestyle shifts, points out Annette Mengel, sales manager, Pacific Harbour.

“People want more open-plan living, modern kitchens and bathrooms and that lovely alfresco experience,” she says.

“Buyers also want the space to work from home. New homes can be specifically designed for these reasons.”

They can also work out to be cheaper — particularly if you’re looking at doing a costly kitchen or bathroom reno.

Mengel says if you’re dreaming of a brand-new kitchen or bathroom, then the costs will start to tip in favour of a new build. Adding new plumbing and gas connections or retiling large areas can quickly see renovating prices spiral.

“If your dream kitchen fit-out in a new build was $50K of the total contract price, that same kitchen being retrofitted to an existing house could well be double that — possibly more,” Mengel says.

2. Reduce maintenance

Relaxed modern lifestyles and home maintenance don’t go hand in hand. The beauty of buying new is that upkeep will be minimal.

“You’re not constantly fixing things like you are in an old property. You have up-to-date warranties for building and appliances,” Mengel says.

3. Future proof for climate change

A growing reason to opt for new is futureproofing for climate change.

Flaherty says buyers are willing to pay more for sustainable designs and features such as insulation, energy efficient heating and cooling and glazed windows.

“In Queensland, there’s extremely strong demand for solar panels. Yes, they’re good for the environment, but they’re also really good for saving on bills,” she says.

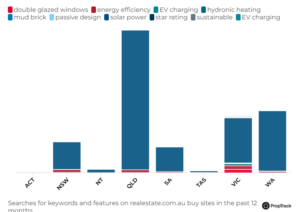

In fact, PropTrack’s recent Energy Efficient Housing Report shows 90% of all searches for energy efficient features in the past 12 months have been for solar power — something which is easier to build into new properties than to retrofit.

Searches for energy efficient features by state

Buying new also means you can have confidence that your home has a Nationwide House Energy Rating Scheme (NatHERS) rating of 6 stars.

4. Beat building price rises

It might seem contrary to headlines of rising interest rates, but there are some good financial reasons to buy new. One is to beat the rising cost of building.

Mengel says that in Queensland, new building codes are set to come into effect in May 2023, which will demand higher energy efficiency standards and will have upfront cost implications. That said, they should offer some energy cost savings over time.

5. Waterfront land becoming more scarce

For buyers seeking the ultimate South East Queensland waterfront lifestyle, opportunities will only get scarcer, explains Flaherty.

For example, across the state, the number of new house and land projects across the state decreased by 25% across the two years to September ’22.

“Australia has a very long coastline, but there’s limited space for new communities and people don’t want to live just anywhere,” she says.

“If you’ve got a waterfront area in a well-located, desirable suburb, those properties are going to be hotly contested.”

Waterfront options such as Pacific Harbour on Bribie Island by QM Properties are rare buying opportunities, Mengel explains. The development also offers parkside and golf course-fronted land, just a short walk from the ocean.

“We’re in the last stages of selling the residential community, so it really is your last chance to buy land and build new there,” she says.

Bribie Island is 80% environmentally protected land, so very little space is available for more development, she adds.

6. Great new communities

Last but not least in favour of buying new is the chance to access the perfect community for your interests and stage in life.

For example, Bribie Island attracts downsizers, families and professionals looking for the perfect work-from-home haven.

“Bribie Island is really premium when it comes to access to nature, but, at the same time, it’s got a real community feel,” she says.

Amenities are also key to the perfect community and Bribie Island has everything buyers need at their doorstep.

“There are plenty of shops, so even though you’re on an island, it’s very connected.”

Land at Pacific Harbour starts from $549,000 for waterside lots and $1.2 million for canal land. New home and land packages start from $850,000 to $2 million.

Mengel adds that when building and buying new, your neighbours will have likely done the same and will be keen to forge lasting connections.

“There’s a population of 18,000 on Bribie Island. We have 30km of white sandy beaches, there’s surf lifesaving, boating and fishing. It’s a real seachange lifestyle.”

Source: www.realestate.com.au