Low vacancy rates and strong demand for rentals has led to a surge in rent prices, with some suburbs seeing increases of over 30% in the past 12 months.

At a national level, vacancy rates are currently 1.42%. Though it is a slight improvement from the historical low of 1.31% in March, it continues to be extremely tough for renters, particularly those in capital cities.

While vacancy rates in regional areas have increased by 0.35ppt in the past 12 months, capital cities have experienced a decline of 0.4ppt meaning that competition for available rentals is worsening.

But what is causing vacancies to remain so low in our capitals?

Demand for rentals in our capital cities has grown strongly over the past two years. The number of potential renters per listing has increased by 40% since May 2021.

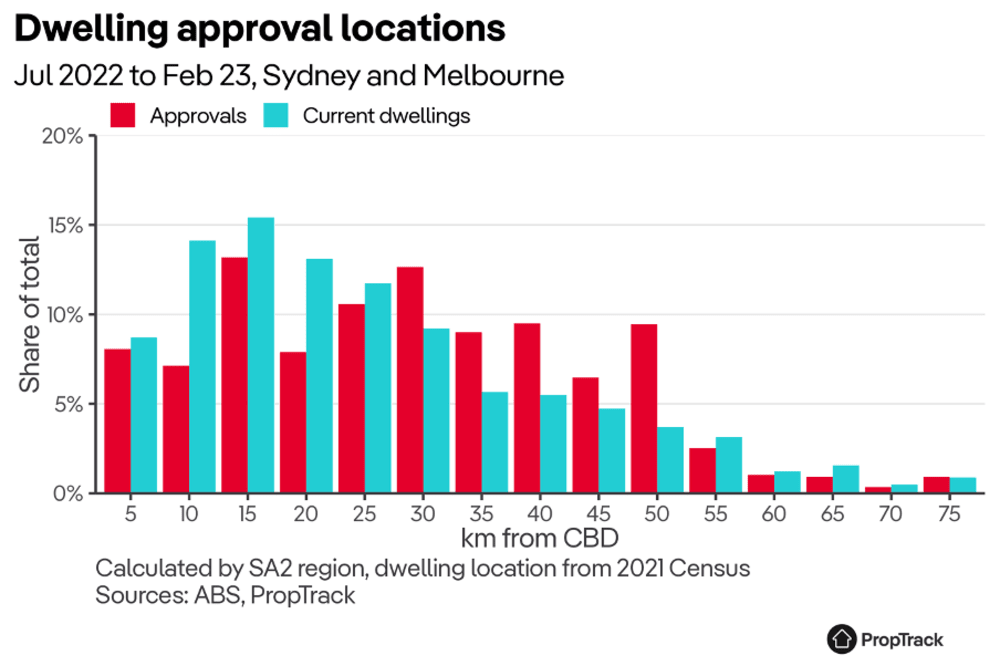

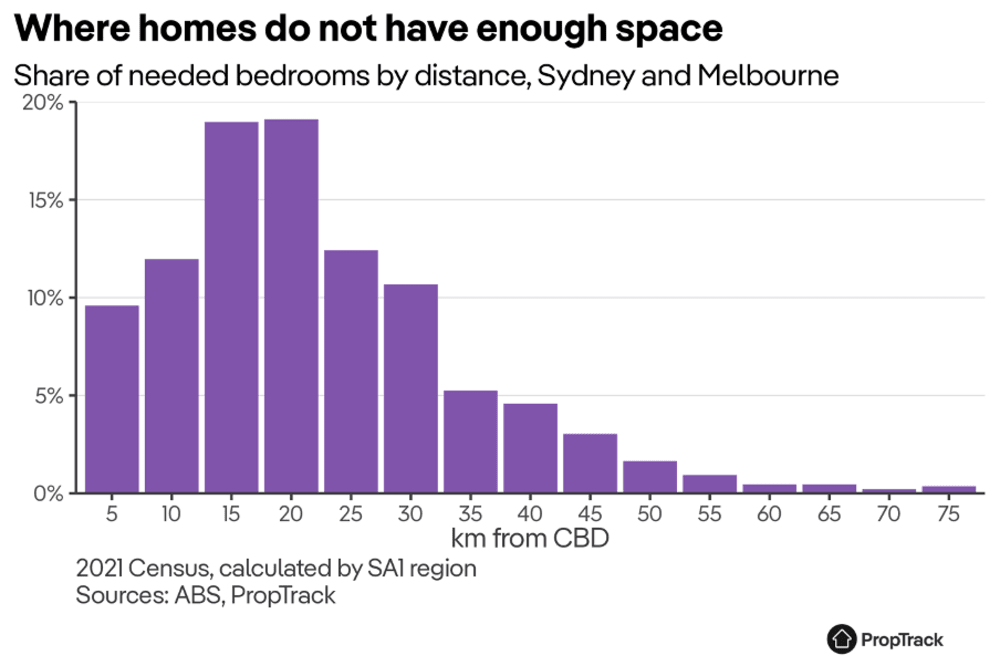

The shift away from remote back to hybrid working and face to face studying has led to the revival of CBDs.

This coupled with the return of migrants, who are more likely to live in inner-city areas, has contributed to strong competition in inner-city rental markets.

Median rents for Melbourne units grew by 38%, which was the most among all capital city suburbs in the past 12 months. Picture: Getty

From the supply side, many investors exited the market at the beginning of the pandemic.

While there has been a rebound from mid 2020, the investor share of new lending remains below the levels seen between 2010-2018, according to the ABS.

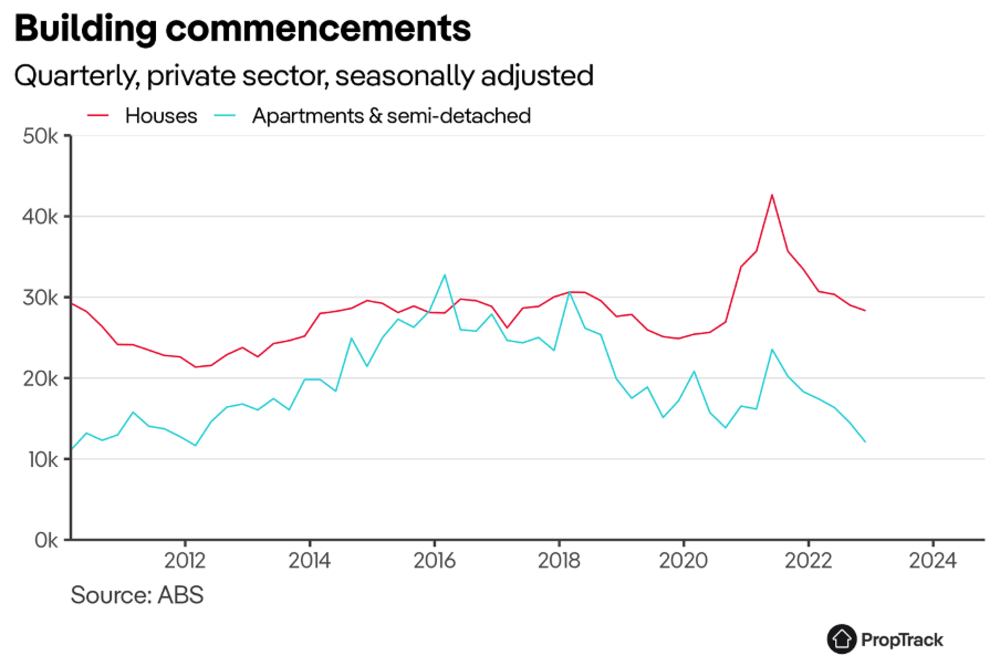

Construction of new homes has also plateaued with new dwelling approvals trending downwards in our three largest states since mid-2021 due to delays in the construction industry and interest rate increases.

These demand and supply factors have made it particularly hard for current and potential renters.

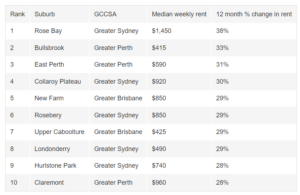

We can get a sense of how tight rental markets are, and where they’re most competitive, by looking at the metro suburbs with the largest annual growth in advertised rents for homes.

For houses, more than half of the top 10 are situated within 10kms of their respective CBDs.

Suburbs with the largest annual growth in advertised rents – House

Source: PropTrack. Only includes suburbs with >= 30 rentals from May’22-Apr’23 and May’21-Apr’22.

Rose Bay topped the list with a 38% increase in weekly rent over the past year while renters in Rosebery experienced increases of 29%.

In East Perth and New Farm, rents rose to $590 and $850 per week, respectively, which saw renters paying around 30% more than the year prior.

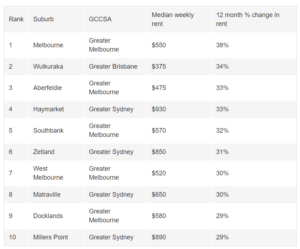

For units, inner city suburbs were also the most impacted by rent rises.

Suburb with the largest annual growth in advertised rents – Unit

Source: PropTrack. Only includes suburbs with >= 30 rentals from May’22-Apr’23 and May’21-Apr’22.

Melbourne, Aberfeldie and Southbank units were popular among renters with rents 38%, 33% and 32% higher than they were a year prior, respectively.

Median advertised rents in Haymarket and Zetland also saw considerable increases with renters now paying $930 and $850 respectively. This reflects an increase of 31-33% annually.

Throughout the pandemic, rents in these areas fell. The growth in the past year in part reflects their recovery but not entirely. Rents are now well above pre-pandemic levels and this is due to the tight market as well.

While market conditions have marginally improved for the regions, it remains exceptionally difficult for renters, particularly those residing or looking to reside in inner-city areas.

With demand high, and few options for improved supply in the short-term, vacancy rates are likely to remain low, and rents are likely to continue growing as a result.

Source: Realestate.com.au