For many mortgage-holders who fixed their home loan at a low interest rate in the past few years, the imminent expiry of their fixed-rate period will mean their minimum home loan repayments jump overnight.

But while it’s a tough time, experts say that, with planning and a careful assessment of all the options, it mightn’t be as bad as people fear.

“There are lots of things people can do right now, and other things they should be doing as the expiry comes closer,” said Kareene Koh, chief executive of Domain Home Loans

“Being prepared can always make a huge difference.”

About 880,000 fixed-rate home loans will be due to expire in 2023, with an estimated 40 per cent facing expiry mid-year.

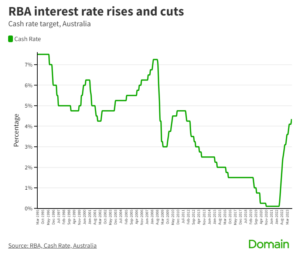

Many of those borrowers fixed their loans when the Reserve Bank of Australia had a record low cash rate of just 0.1 per cent, from November 2020 to April 2022.

The interest rate on their loans — locked for a fixed period of one to 10 years — would have been a few percentage points higher than the cash rate, with some borrowers locking in an interest rate below 2 per cent.

Having fixed their interest rate, their mortgage repayments wouldn’t have changed over that time, despite successive rate hikes by the RBA since May 2022.

What happens when your fixed-rate period ends?

When the fixed-rate period on a home loan ends, that fixed rate will revert to the lender’s variable standard rate.

Variable rates have been steadily rising since last year in line with 10 successive hikes by the RBA to the cash rate target, which is now sitting at 3.85 percent.

Source: RBA, Cash Rate, Australia

A typical borrower with a variable-rate loan can now expect an interest rate of about 6 per cent.

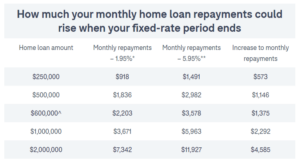

Borrowers whose fixed-rate loans are expiring this year will see their required minimum repayment amounts rise sharply based on however much their lender’s variable rate is above their low fixed rate.

“This could be a rude shock, unfortunately, as this is often the cohort who bought before, or during, COVID, and they’ve never seen cash rate increases before,” said PRD chief economist Dr Diaswati Mardiasmo.

How to prepare if your fixed rate is expiring

The most important thing people can do now, in advance, is become more informed about their situation.

“A lot of people don’t even know what interest rate their loan is today, let alone what it’s likely to move to,” said Koh. “So you have to gather all your facts and do your research now, as that process takes time.

“You should also start preparing yourself for what is to come. Will you have to dig into your savings and pay some of the principal on the loan so repayments are lower, or will you need to make changes to your lifestyle?

“If you think you’ll have to adjust your lifestyle, that generally takes people three months. So why not start now and see how it feels, and if you struggle, and think they’re changes you’re not willing to make, take decisions about alternatives?”

Source: Domain Home Loans Repayment Calculator.

The above table shows approximate amounts monthly home loan repayments could be when the fixed rate period on a home loan ends and a borrower rolls onto a variable rate. Estimates are based on a 30-year principal and interest loan, fixed for two years at 1.95 per cent in May 2021. Fees and charges are excluded, and this information is intended as a guide only.

*Average fixed rate, May 2021, ABS

**Assumes 400 basis point increase to the cash rate target between May 2022 and May 2023 (NAB and ANZ forecasts, February 2022) passed on in full to borrowers.

^Approximate average loan size for owner-occupier dwellings, ABS.

Those people who took out their mortgages recently on fixed rates, often borrowing to their absolute limit, could find themselves in difficulty and for them it’s vital they start the preparation early, warns independent economist Harley Dale.

“They’ll also have to take into account the forecast of multiple rate rises yet to come from the RBA,” he said. “So if they weren’t ready for the ones that have happened – that the RBA said wouldn’t happen till 2024 – they have to be ready now for more.”

Two months out from the expiry, people should start researching the different rates available in the market, looking at whether to go on another fixed rate or choose a variable one, and talking to a broker about all their options, advises Koh.

“There are a lot of different possibilities available and if any of them can shave … a few thousand dollars off the mortgage, they’d be worth having,” she said. “It’s important to shop around.”

As part of that process, Mardiasmo recommends starting a spreadsheet to lay out all the possibilities, so you can better compare rates, any cashback offers, set-up fees, any exit fees and refinancing options.

“Rates do vary and one bank is now even offering $6000 cashback, while others are offering $2000 or $3000,” she said.

And if people are unwilling to trim costs within their lifestyle or dip into savings, then there are always other options, says Koh. That might be taking in a roommate to share bills, doing more paid work to enhance income or — perhaps the last resort — renting out the property, and moving back in with parents.

Source: Domain.com.au