Despite worsening affordability easing the pace of rental growth in Australia, rental availability tightened in September, with vacancy rates falling to new record lows across the country.

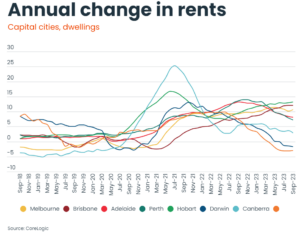

CoreLogic’s Quarterly Rental Review for Q3 2023 shows rental values rose 1.6% over the quarter, down from the 2.2% rise seen in the June quarter and a full percentage point below the recent peak rate recorded over the three months to April (2.6%). This took the annual pace of growth down from a revised peak of 9.6% in the previous 12 months to 8.4% in the year to September.

However, a continued shortfall in rental listings saw the national vacancy rate reduce to a new record low of 1.1% in September as the total count of national rental listings fell to its lowest level since early November 2012.

CoreLogic Economist and report author Kaytlin Ezzy said there were a number of factors at play driving the slowdown in rental growth amid such limited rental availability.

“Worsening affordability continues to be a significant factor placing downward pressure on the pace of rental growth in recent months,” Ms Ezzy said.

“After recording a small dip over the first few months of COVID, national rents have risen for 38 consecutive months, taking rental values 30.4% higher since July 2020 and adding the equivalent of $137 to the median weekly rent. With the rising cost of living adding additional pressure on renter’s balance sheets, it is likely tenants have hit an affordability ceiling, seeking to grow their households to share the growing rental burden.

“The situation of low rental vacancy rates and insufficient housing supply is a broad issue impacting regions around the country to different extents. Record high net overseas migration, fuelled by a combination of an increased flow of new arrivals and weaker departure numbers, coupled with a continued shortfall in rental listings, saw the vacancy rates falling to new record lows across both the combined capitals (1.0%) and combined regional markets (1.2%),” she said.

Over the four weeks to October 1st, the total count of national rental listings fell to its lowest level since early November 2012, with just 90,153 properties listed to rent. This equates to a rental shortfall of approximately 47,500, with total listings -15.1% below the levels seen this time last year and -34.5% below the previous five-year average.

Rental growth across the capital cities continues to outpace the combined regionals, with rents up 1.9% and 0.7% respectively over Q3. Both markets saw the pace of rental appreciation ease over the quarter, falling -80 basis points across the capitals and -10 basis points across the regions.

Gap between house and unit rents expands to $36/week as house rents pick up pace

Rental growth for houses is now rising faster than unit rents, up 1.7% and 1.3% respectively over Q3.

“Since peaking at 4.3% over the three months to April, the pace of quarterly rental growth across Australia’s unit sector has plummeted by more than two-thirds taking the gap between the median house and median unit rents from $33 in May to $36 in September,” Ms Ezzy said.

“Worsening affordability in the unit sector, coupled with a potential shift towards larger rental households, has likely helped rebalance demand between the two property types. Much of the unit sector’s relative affordability has been eroded through the recent rental surge, with unit rents rising 11.7% over the past 12 months compared to the 7.1% rise in house rents.”

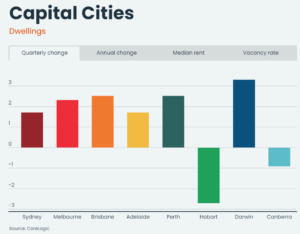

Diversity in rental conditions across the capitals

While headline figures showed a general easing in rental appreciation, across the individual capitals, growth conditions were more diverse. Darwin recorded the strongest quarterly rise in dwelling rents (3.3%), followed by Brisbane (2.5%), with both markets recording an increase in the pace of growth over the quarter.

In contrast, Perth (2.5%), Melbourne (2.3%), Sydney (1.7%), and Adelaide (1.7%) all saw the pace of rental growth ease, while rents across Hobart (-2.7%) and Canberra (-0.9%) declined.

Sydney maintained its position as the most expensive capital city rental market, with median dwelling rent at $726 per week, followed by Canberra ($649p/w) and Darwin ($615p/w). Adelaide ($548p/w) lost the most affordable rental capital title to Hobart ($529 p/w), with Adelaide recording a quarterly rental rise equivalent to $9 p/w while Hobart rents fell -$15 p/w.

Yields contract as growth in values outpaces rents

With the quarterly trend in national values (2.2%) once again outpacing quarterly growth in national rents (1.6%), national gross rental yields recorded a mild decline over the quarter, falling three basis points to 3.69% in August before rising two basis point to 3.71% in September.

While down two basis points from the recent peak recorded in April (3.73%), national gross yields remain 20 basis points above those recorded this time last year (3.51%) and 55 basis points above the recent low record in January 2022 (3.16%).

Source: corelogic.com.au