Australian dwelling values have regained the losses from the recent downturn and surpassed their previous peak to reach a new record high, CoreLogic’s national daily HVI shows.

After reaching a peak in April 2022, national home values fell -7.5%, finding a floor on 29 January 2023. Since bottoming out, the national HVI has risen by 8.1%, taking the market to a new record high on Wednesday 22 November 2023.

CoreLogic’s Executive Research Director, Tim Lawless, said it took around nine months for the National HVI to move from record highs to the recent trough, then roughly ten months to recover from the short but sharp downturn.

“The ‘V’ shaped recovery may seem counter intuitive, given high interest rates, deeply pessimistic levels of consumer sentiment and high cost of living pressures, however the recovery can be explained by an imbalance between supply and demand,” Mr Lawless said.

“From a supply perspective, advertised stock levels have held remarkably low through 2023. Although inventory levels are now rebalancing as vendor activity picks up, listings remain 16.6% below the previous five-year average nationally. At the same time, demonstrated demand, based on the volume of homes sales, is trending roughly in line with the five-year average.”

Change in national home values from April 2022 peak

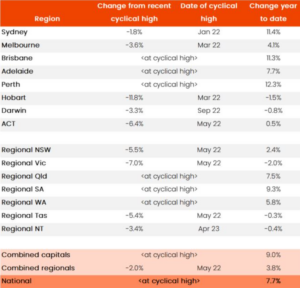

While the national index has reached a new record high, the headline figures hide a growing level of diversity in housing market conditions. Across the capital cities, Perth, Adelaide and Brisbane are all at record highs, with their regional counterparts Regional WA, Regional SA and Regional Queensland also at new peaks.

At the other end of the scale is Hobart, where values remain -11.8% below their peak and Regional Victoria, where dwelling values are -7.0% below their record highs.

Change in dwelling values, Major Regions as at 22nd November, 2023

![]()

As housing values continue to trend higher across most regions, Mr Lawless said we are likely to see more areas return to record high housing values.

“While this is great news for home owners, for those looking to buy, affordability pressures are becoming more pressing amid rising values, high interest rates and worsening serviceability challenges.

“The good news for prospective buyers is that the pace of growth is clearly easing in some markets as advertised stock levels rise and purchasing demand remains fragile.”

Source: corelogic.com.au