CoreLogic’s national unit index shows unit values nationally increased for the first time in 11 months, increasing 0.6% over March.

Highlights from this month’s Unit Market Update include:

- Nationally unit values increased 0.6% over March, rising for the first time in 11 months. The subtle increase seen in Sydney unit values in February became more geographically broad-based, with six of the eight capitals recording a monthly rise in unit values.

- Sydney recorded the strongest monthly growth in unit values across the capitals, up 1.0%, followed by a 0.4% lift in Melbourne.

- National unit rents continue to rise at roughly twice the pace of house rents, up 1.6% and 0.8% over the month and 3.9% and 2.0%, respectively, over the first quarter.

- The stronger rental growth seen in the medium to high-density sector has seen the gap between the median house and unit rental value narrow from $85 this time last year to $65 in March.

- The combined capitals recorded its strongest quarterly increase in unit rents on record, rising 4.4% over Q1, equivalent to a $23 per week increase in the average rental value ($550).

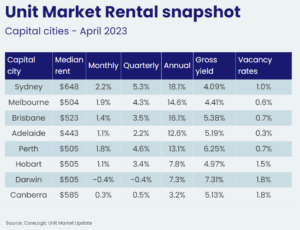

- Darwin was the only capital city to see unit rents decrease over the quarter (-0.4%).

- The national unit vacancy rate fell to a new record low of 0.8% in March.

Outlook for the unit market

The outlook for Australian unit values is starting to look more positive, with this month potentially signaling a change in the direction of values, however there are still some challenges ahead. Arguably we are yet to see the full impact of interest rate rises, with many fixed-rate loans only now starting to expire, while three of Australia’s four major banks still expect the cash rate to rise a further 25 basis points in the coming months. Additionally, while listing levels are currently holding low, we could see listing levels rise, which would add downward pressure on values if not met with an equivalent rise in demand.

On the flip side, we could see this month’s rise in values become the start of a slow recovery phase, with inflation seemingly moving past its peak and consumer sentiment rising from near-record lows.

Source: corelogic.com.au