Here are the must know stats, facts and figures on Australia’s residential property market.

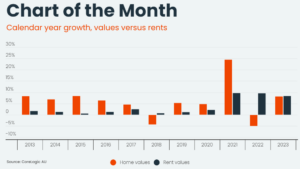

Annual growth in home values have seen ups-and-downs while rent values have increased at more than 8% for the past three years.

January’s ‘Chart of the Month’ shows over the past decade, rents have outpaced values only three times over a calendar year, in 2023, 2022 and 2018.

Other highlights from the January Housing Chart Pack include:

- The value of residential real estate was an estimated $10.3 trillion at the end of December, which was relatively steady on the previous month.

- Both the combined capital city dwelling market and the regional dwelling market saw a rise of 1.5% in the December quarter.

- The growth trajectory for housing values across the combined capitals has broadly slowed since late May. However, the pace of growth remained relatively steady through the four weeks ending January 10th.

- Perth led capital growth performance in the greater capital city markets. In the 2023 calendar year, Perth home values increased 15.2%. Perth dwellings also had the strongest quarterly growth of the capital city dwelling markets, rising 5.1%.

- In 2023, CoreLogic estimates there were 488,898 sales nationally. This is -2.8% lower than in 2022, but sales are now trending slightly higher than the five-year average.

- The median time it takes to sell a capital city home was trending lower through 2023, but moved slightly higher in the December quarter to 29 days. The median selling time for regional Australian dwellings is 41 days, which is up from 36 days a year ago, but remains well below the pre-COVID average.

- Discounting rates also narrowed in 2023 as selling times reduced. Across the capital cities, the median vendor discount shrank from -4.3% in the December 2022 quarter to -3.5% in the December quarter of last year. Towards the end of last year, there was a slight deterioration in the median vendor discount.

- As with the capital growth trend, the final clearance rate across the combined capital cities market trended lower at the end of 2023. In the four weeks ending 17 December, the average final clearance rate was 58.9%. This was down from 62.5% at the end of November, though still higher than the 55.1% average recorded in the same period of 2022.

- Australian rent values increased a further 0.6% in the month of December, taking the national annual increase to 8.3%. Annual growth in rent values has accelerated slightly, from the 8.1% increase recorded in the 12 months to October.

- Dwelling approvals increased 1.6% in November, driven by a 7.2% increase in the more volatile unit segment. Approvals trended a little higher over 2023, but remain relatively low overall. For the past six months, monthly dwelling approvals have averaged 13,760 a month, below the decade average of 17,254.

- The January ‘Chart of the Month’ shows calendar year growth of home values and rent values over the past ten years. Rent values have had three strong years of consecutive increases, against mixed capital growth performance.

Source: corelogic.com.au