Australian home prices are forecast to rise as much as 5% in 2023 amid the interest rate hikes and cost of living pressures facing homeowners over the past year.

PropTrack’s Property Market Outlook Report, released today, predicts home prices will increase between 2% and 5% nationwide this year, with most capital cities posting gains.

The new forecast comes after home prices staged a solid rebound in 2023, with the PropTrack Home Price Index recording its seventh consecutive month of price rises in July.

Cameron Kusher, director of economic research at PropTrack and the report’s author, said the new forecast had been influenced by this year’s housing market recovery.

“We’ve seen a rebound in property prices this year and we certainly weren’t expecting it – most people were expecting prices to continue to fall this year,” Mr Kusher said.

“It’s a bit unclear what the specific drivers are, but one of the main drivers is the number of properties coming to market have remained very low through most of this year, although it has started to pick up over the past couple of months.

“Migration to Australia has also been really strong and we’ve seen a rebound in sales this year as well.

Perth is expected to reap the biggest price gains this year, up between 4% and 7%, followed by Sydney and Adelaide with prices set to grow between 3% and 6%.

Brisbane and Canberra home prices were on track to edge higher, rising between 1% and 4%, and 0% and 3%, respectively.

Melbourne price expectations ranged from falling 1% to growing as much as 2%.

Darwin and Hobart prices were tipped to fall or flatline during the calendar year, down as much as 3% and 6%, respectively.

As of July, national property prices were sitting just 1.44% below the March 2022 peak.

Home prices soared almost 35% from the start of the pandemic in March 2020 to March 2022, marking one of the fastest periods of price growth on record.

PropTrack economic research director Cameron Kusher says home prices are expected to rise between 2% and 5% this year. Picture: Realestate.com.au

Slower home price growth next year

The report also forecasted slower home price growth of up to 3% for 2024.

Mr Kusher noted difficulties in next year’s forecasts given the uncertainty of factors such as the supply of homes for sale, macroprudential policy changes and interest rates

“It’s starting to look like interest rates might be close to their peak, but if interest rates were to be cut next year, people would be able to borrow more and that would bid up prices,” Mr Kusher said.

Alternatively, if they stay higher for longer and we do get that additional supply of housing coming to the market, then prices could start to fall again. So it’s quite difficult to forecast what will happen next year at this stage.”

Earlier this week, the Reserve Bank of Australia held interest rates steady for a second straight month, giving borrowers hope the central bank had reached the end of its tightening cycle.

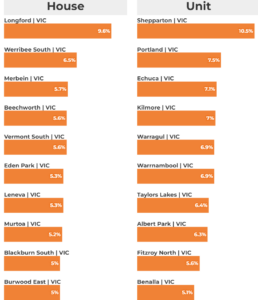

Top 10 suburbs with the largest 6 month growth in AVM

Australia

Victoria

Source: PropTrack • AVM 6 month growth: Only includes suburbs with > 500 dwellings. Compares Dec’22 to June’23.

The rapid pace of interest rate rises, which saw the cash rate surge from 0.1% to 4.1% since May 2022, has also raised questions around whether the Australian Prudential Regulation Authority (APRA) should relax the loan serviceability buffer from its current 3%.

Under the rules, banks must include a 3% buffer on home loan applications to ensure borrowers can weather interest rate rises.

However, some borrowers have struggled to refinance their home loans under the current rules following the series of recent cash rates hikes.

During the 12 months to June this year, home prices rose 5.7% in Perth, 5.3% in Adelaide, 1% in Sydney and 0.1% in Brisbane.

Home prices fell in 6.4% in Hobart, 3.5% in Canberra and 2.9% in Melbourne during the 12 month period.

Australia’s median house price reached $770,000 during the three months to June 2023, while the median unit price sat at $590,000.

Source: realestate.com.au