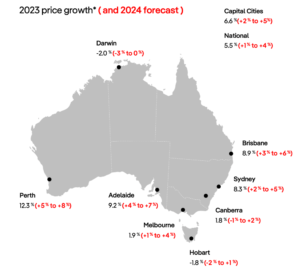

Stage three tax cuts, soaring population growth and lagging housing supply could see national property prices rise up to 4% over 2024, and as much as 8% in some capital cities, a new report predicts.

The latest PropTrack Property Market Outlook Report, released Thursday, forecasts home prices across the country will grow between 1% and 4% over the next 12 months, slightly slower than the 5.5% pace of growth recorded so far in 2023.

Note: 2023 price growth is year-to-date from January to November 2023. Source: PropTrack

Property prices reached new record highs in November after rising for an eleventh consecutive month.

PropTrack director of economic research and report author Cameron Kusher expects the trends that fuelled prices in 2023 will likely persist, underpinning price growth next year despite higher interest rates.

“Reflecting on 2023, a number of factors drove the home price rebound,” Mr Kusher said.

“The volume of stock available for sale remained at persistently low levels while buyer demand also increased significantly, fuelled by a housing shortage and strong population growth.”

Over the 12 months to March 2023, Australia’s population increased by 563,205 persons – the equivalent of the entire population of Tasmania.

“More up-to-date indicators from overseas arrivals and departures data show little evidence of a slowdown,” Mr Kusher said.

Cameron Kusher sees further price growth nationally in 2024, with some capital cities to outperform.

The planned stage three tax cuts, due to come into effect from the middle of next year, could also fuel demand for housing as higher income earners get a boost to their take home pay.

“These factors will likely lead to further price gains.”

Where prices are expected to rise the most

While the pace of price growth is tipped to slow nationally, forecasts vary widely across states and territories as imbalances between supply and demand intensify.

In Sydney and Melbourne, where total listing volumes are now back above the decade average, price growth is set to be more subdued, compared to Brisbane, Adelaide and Perth where supply remains extremely tight.

“In Brisbane, Adelaide, and Perth, total listings were more than 30% below their November decade average,” Mr Kusher said.

By comparison, total listings in Sydney and Melbourne are 1.6% and 10.8% above their long-term average respectively.

Total listings are up from a year ago but are 23.9% below their November decade average. Source: PropTrack

Sydney prices are forecast to rise between 2% and 5% in 2024, down from a strong 8.3% in 2023. Melbourne is expected to see growth of between 1% and 4%.

Mr Kusher said Perth (+5% to +8%), Adelaide (+4% to +7%), and Brisbane (+3% to +6%) are likely to lead home price growth across the country after consistently recording strong gains in 2023.

Prices could ease in the smaller capital cities of Canberra (-1% to +2%), Hobart (-2% to +1%), and Darwin (-3% to 0%), the report predicts.

“Looking at home prices in 2024, it’s important to consider the current market trajectory, where interest rates could head, what could happen with housing supply, and the impact of the interest rate hikes that have already occurred,” he said.

Lagging supply is expected to drive growth in Perth, Adelaide and Brisbane. Picture: Getty

The Reserve Bank of Australia handed households an early Christmas present on Tuesday after leaving interest rates on hold at its final meeting of the year.

But the previous 13 rate hikes between May 2022 and November 2023 have seen mortgage repayments surge by 62% on average, and reduced borrowing capacity by more than 30%.

AMP chief economist Shane Oliver estimates a variable rate borrower with a $600,000 mortgage will have seen around an extra $17,000 a year added to their mortgage payments.

“Most may have sought a better deal but even if they got a 0.5% discount on their mortgage rate it would now amount to an extra $14,900 in extra mortgage payments,” Mr Oliver said.

“It’s hard to see this not having a big impact on household spending. Particularly given the RBA’s analysis based on variable and fixed borrowers that around one in seven households with a mortgage were already cash flow negative in July, which will likely be higher by now.”

Rate cuts expected in 2024

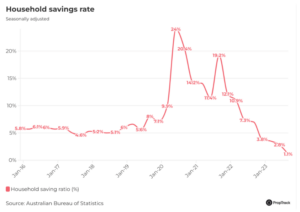

Data from the Australian Bureau of Statistics on Wednesday revealed the household savings rate fell to 1.1% in the September quarter, its lowest level since December 2007 and down from the pandemic high of 24%.

AMP estimates the household savings rate will turn negative over the coming quarters as households continue to run down buffers accumulated during the pandemic.

CBA head of Australian economics Gareth Aird said the savings rate is now comfortably below its five-year pre-pandemic average of 6%.

“The data is reflecting a stretched household sector that at the individual level is cutting back on spending due to the effects of elevated inflation, rising interest payments and a big lift in tax payable,” he said.

It’s the latest round of economic data to come in softer than expected, with inflation easing to 4.9% over the year to October, raising bets that the RBA may be forced to start cutting rates next year.

Interest rates are widely expected to have already peaked. Picture: Getty

CBA expects the first rate cut to occur in September 2024.

“A month ago the risks to our call were skewed towards rate cuts starting at a later date. But the run of both domestic and international data over the past month suggests the risks are now more evenly balanced,” Mr Aird said.

Economists at ANZ also see rates on hold until it the RBA begins easing at the end of next year.

But NAB expects one more rate hike in February, which would take the cash rate to 4.6%, before remaining on hold until late 2024.

But Mr Kusher said the housing market has remained resilient with “few forced sales, and price growth and demand lifting in 2023.”

“Despite higher interest rates reducing borrowing capacities and housing affordability, a large depreciation in prices over 2024 is still unlikely,” he said.

The trends to shape 2024

A regional resurgence is one of four key trends set to shape the property market in 2024, the report predicts, as deteriorating affordability in the capital cities pushes more people out.

Speaking to the forecast, PropTrack economist Anne Flaherty said regional home prices have risen at less than half the speed of capital cities over the past 12 months.

“With affordability currently at record low levels, more home buyers will be pushed further out to the regions and this trend is expected to remain,” Ms Flaherty said.

A regional resurgence could be in store for 2024, according to new forecasts from PropTrack. Picture: Getty

“Price growth is forecast to continue into 2024, with the supply of homes for sale predicted to remain subdued relative to buyer demand.

“Furthermore, population growth is likely to outpace development activity, which will continue to be hampered by high costs and build times.”

PropTrack senior economist Paul Ryan sees upgrading homeowners taking advantage of large equity boosts as another ‘key influence’ to shape the market in 2024.

“A higher share of borrowers with large deposits is one reason why prices in 2023 have been so resilient to higher interest rates,” Mr Ryan said.

“High-deposit buyers are more insulated from the higher interest rate environment, but the question for 2024 is: how many of these upgraders are left?

“Buyers with large deposits will likely continue to make up a higher share of the market in 2024, and play a part in keeping prices elevated, despite higher interest rates.”

But PropTrack senior economist Angus Moore expects deteriorating affordability will also keep first-home buyers on the sidelines next year.

“Rapidly rising interest rates throughout 2022 and in to 2023 have chilled first-home buyer activity,” Mr Moore said

“In 2022, there were about 30% fewer first-home buyers. While housing markets have stabilised in 2023, first-home buyers have stayed quiet.

“To date in 2023, activity has been even more subdued than in 2022.”

Unless the outlook changes materially, Mr Moore said this situation is unlikely to improve for first-home buyer activity.

Finally, PropTrack senior economist Eleanor Creagh noted extreme tightness in the rental market will underpin house growth, as those with the means to purchase take the step into homeownership sooner than they otherwise would have.

“Tight rental markets and strong rental price growth also entice investor activity, as well as perpetuating a shortage of stock for sale, a factor that underpinned prices this year,” Ms Creagh said.

“As such, tight rental markets and strong rental price growth are likely to continue to buffer home price falls.

PropTrack data shows the national vacancy rate fell to its lowest level on record in October.

Source: realestate.com.au