After near-record rises during the pandemic, home prices in most parts of the country began to fall halfway through last year.

Headlines warning of declines at the fastest rate in decades began to appear.

Those declines, coupled with talk of recession-like economic conditions and predictions of property values falling further on the back of rising interest rates, caused anxiety among would-be homebuyers and sellers.

But just nine months after markets began cooling, there are signs that conditions could be warming up once more.

Is the correction over? Has the housing market bottomed out?

“After nine months of price falls, national home prices have reversed their falling trend,” PropTrack senior economist Eleanor Creagh said.

“Price falls began to ease in the final months of last year are now moving higher.”

In fact, PropTrack data shows that in March national home prices increased for the third consecutive month.

“National home prices continued to stabilize in March and moved slightly higher by 0.13%, bringing the cumulative bounce to date to 0.49% for the quarter,” Ms. Creagh said.

“Prices bounced in every capital city, except Hobart, Darwin and Brisbane, with Sydney, Perth and Melbourne recording the largest jumps.”

Data indicates the property market correction has come to an end, with prices rising once more. Picture: Getty

Factors driving market conditions

While interest rates have been the primary driver of price falls to date, the impact of these hikes is being counterbalanced by numerous factors.

“The commencement of the Reserve Bank’s aggressive approach to curbing inflation through rate hikes immediately impacted housing markets across Australia,” Real Estate Institute of Australia president Hayden Groves said.

“But we’re already seeing market declines stabilise as population growth and supply shortages shore-up demand.”

Net immigration ran at about 320,000 last year, up from a mere 5940 in 2021 at the height of Covid.

The figure throughout 2023 is likely to remain strong.

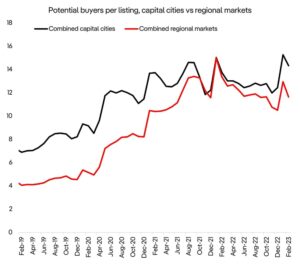

Homebuyer demand remains elevated despite market jitters. Picture: PropTrack

This population growth through immigration has combined with limited stock to drive rising prices, Ms. Creagh said.

“Although the significant reduction in mortgage affordability and borrowing capacities implies further price falls, the downward pressure on prices from the substantial tightening already pushed through is being countered by positive demand drivers stemming from the strong rebound in immigration, and very tight rental markets.

“Fewer properties are hitting the market compared to the same time last year, which is creating a more competitive buying environment and buoying home values as there remains sufficient buyer demand to help keep prices resilient.”

The ‘mortgage cliff’ impact

While there are factors driving the national market correction, a bottoming out isn’t guaranteed.

The RBA estimates about one million mortgage holders are due to face a so-called ‘mortgage cliff’ when they roll off very low fixed interest rates onto higher variable rates.

“The ‘mortgage cliff’ approaching will impact about 800,000 mortgagors in 2023 alone and this will probably lead to an uptick in supply especially in the more affordable regions,” Mr. Groves said.

Borrowers facing mortgage payment hikes have been tightening belts as a result, which has been seen in evidence showing decreased household spending nationwide.

“With consumer spending set to slow sharply, economic activity is set to weaken in the coming months as the full impact of rate rises already delivered catches up to households, businesses, and economic conditions,” Ms. Creagh said.

“If inflation pressures are more persistent than expected and the reserve bank raises interest rates further than expected the decline in prices could find a second wind, particularly if we see an increase in stock levels in the coming months, removing a pillar of support for home prices, and together with the downwards pressure from rate rises, price falls may resume.”

Has the recovery begun?

Despite stabilizing prices, mortgage rate hikes, and various economic factors coming into play, homeowners, investors and experts are all hedging their bets when predicting the property market over the next six to 12 months.

Given this uncertainty, experts say it’s likely too early to call the bottom of the market.

The path for home prices will be influenced by many variables, including the level of supply hitting the market and the trajectory of interest rates.

“If the RBA pause their tightening cycle, it’s possible the bottoming process continues, with the bounce in home prices firming and values stabilizing as uncertainty eases,” Ms. Creagh said.

“If the listings environment remains constrained, with fewer properties coming to market and low supply persists, that may continue to put a floor under prices and counter the downward pressure from the lagged effect of the higher interest rates.

“Positive demand drivers stemming from the shortages in rental supply and rebounding international migration also remain.”

A shortage of homes for sale is keeping a floor beneath prices. Picture: Getty

Mr. Groves agreed that the conflicting forces of increasing cost of living pressures and rising interest rates means the likelihood of a new market ‘boom’ is still very much unknown.

“The breakout of the market either way will be the winner of this contest between rising interest rates and the threat of recession which could lead to a market constriction and the lack of housing supply which, with increased demand, could lead to price increases.

“Until interest rate rises cease and cost of living pressures stabilize, most Australian markets will bounce along the bottom for a while with the chance of returning to ‘boom’ conditions being slim.

“Affordability is nearing record lows and with wages growth remaining under inflation, some fundamental economic indicators suggest stability of property values over the remainder of this year and into 2024.”

Source: realestate.com.au