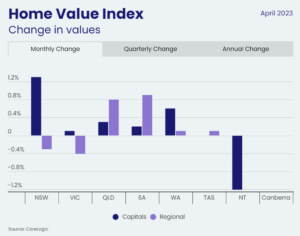

After falling -9.1% between May 2022 and February 2023, Australian housing values look to have bottomed out, posting a second consecutive monthly rise. CoreLogic’s national Home Value Index (HVI) increased by half a percent in April, following a 0.6% lift in March to be 1.0% higher over the past three months.

Sydney increased 1.3% in April and is leading the positive turn in housing conditions, with dwelling values rising each month since February. Sydney values arenow 3.0% higher than the recent trough recorded in January. In further evidence that a positive growth trend has emerged, the four largest capital cities all recorded a rise in housing values over the rolling quarter.

According to CoreLogic’s Research Director, Tim Lawless, it is becoming increasingly clear the housing market has moved through an inflection point. “Not only are we seeing housing values stabilising or rising across most areas of the country, a number of other indicators are confirming the positive shift. Auction clearance rates are holding slightly above the long run average, sentiment has lifted and home sales are trending around the previous five-year average,” he said.

The more positive trend in housing values comes amid a worsening imbalance between supply and demand. “A significant lift in net overseas migration has run headlong into a lack of housing supply. While overseas migration would normally have a more direct correlation with rental demand, with vacancy rates holding around 1% in most cities, it’s reasonable to assume more people are fast tracking a purchasing decision simply because they can’t find rental accommodation,” Mr Lawless said.

“Many prospective vendors have stayed on the sidelines through the downturn, keeping inventory at below average levels and providing sellers with some leverage at the negotiation table.”

Mr Lawless said the growing expectation the rate hiking cycle is over, or nearly over, following a sharp decline in values was another likely factor supporting housing demand.

“This could be contributing to a broader perception that the market has bottomed out, and for those attempting to time the market, that it is considered to be a good time to buy,” he said.

“As interest rates stabilise there is a good chance consumer sentiment will improve, bolstering housing market activity from both a purchasing and a selling perspective.”

Notably, the trend towards more positive housing market conditions has occurred while interest rates remain well above average. “The last time we saw housing values trending higher through a rising interest rate environment was during the mid-to-late 2000’s when the mining boom was underway. This period was also characterised by surging net overseas migration that contributed significantly to housing demand,” Mr Lawless said.

Regional markets are showing greater diversity, however the trend remains one where values are generally stabilising or rising. Regional NSW (-0.3%) and Regional Victoria (-0.4%) were the only rest of state regions to record a fall in housing values over the month, however the quarterly trends in these regions are on a clear trajectory towards a stabilisation in values.

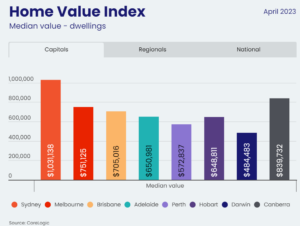

Although housing conditions are looking more positive, values across most regions remain well below their recent cyclical highs. Hobart, where values are yet to improve, is now recording the largest drop from the recent market peak, down -13.0%. Sydney dwelling values had recorded a -13.8% drop from the market peak to recent trough, however a 3.0% rise in values over the past three months leaves the market -11.2% below the recent high. Brisbane has recorded the third largest decline, with values holding -10.7% below their recent peak.

Several regions reached a new cyclical high in April 2023. Strong growth over the past two months saw Peth recover all of its recent declines, taking values to a new record high. Regional SA and Regional WA also recorded new cyclical peaks, although Regional WA values remain -13.7% below the record highs recorded in early 2008.

Source: corelogic.com.au