Older Australians are far more likely to own an investment property than younger Australians, a trend that has been growing over time.

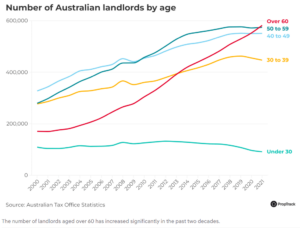

More than half of all property investors are aged over 50, with those aged over 60 accounting for the largest share of any age group, according to the Australian Tax Office’s latest statistics.

To understand why this is bad news for renters we need to look at the different motivations of property investors and how these shift across different life stages.

Broadly speaking, there are two main strategies when it comes to investing in real estate: generating yield through rental income and achieving capital growth.

While both strategies can be, and often are, simultaneously achieved, typically an investor is more motivated by one over the other.

The number of landlords aged over 60 has increased significantly in the past two decades.

A younger investor, with many years left in the workforce, is more likely to favour a capital growth strategy.

In this case, they are less concerned if the costs associated with holding an investment property are greater than the rental income received, a circumstance known as negative gearing. For these investors, negative gearing has the added benefit of reducing their taxable incomes.

But as an investor enters retirement, the focus shifts away from chasing capital growth and harnessing negative gearing. Instead, the strategy moves towards generating passive income via the rent received.

The income an investment provides, relative to the value of that investment is known as yield. But over recent years, and particularly post-COVID, the net yield from holding investment properties has fallen, despite significant rent growth.

This is due to the rising costs associated with holding property. Interest-only home loan rates to investors, for example, have risen from a low of 3.2% in April 2022 to 5.8% as of June 2023. For a loan of $400,000, this represents an extra $10,640 in repayments per year, or $205 per week.

Rising costs of holding a property, such as mortgage interest, land tax and insurance, have reduced returns for some investors. Picture: Getty

Land tax is another expense that has jumped significantly. The median price of a property was sitting 33 per cent higher in July of this year compared to March 2020 at the onset of the pandemic. While this is fantastic news for anyone looking to sell, for those holding onto their properties it means a higher land tax bill.

Costs associated with insurance, strata, and compliance have also jumped significantly in recent years. In fact, 50 per cent of landlords believe that investing in property is not as attractive as it used to be, according to realestate.com.au’s latest Property Seeker Survey, conducted in May this year.

What’s more, 32 per cent of the landlords surveyed stated they believe that the returns from investing in property are not worth the effort. This sentiment is more likely to be found among those who are reliant on the income from their properties to fund their retirements.

And while the yield from holding property has decreased, interest rates on lower risk investments such as bonds or even savings accounts have risen significantly.

All of these factors are prompting more investors to sell up, and over the past five years the share of investors selling has been higher than the share buying — a trend that has accelerated post-COVID.

For the owner occupiers who purchase these former investments, this can be seen as good news. But not everyone is in a position to buy, and currently about one third of Australians rent, a share that has been growing over time.

Given the current shortage of rental properties, the fact we are likely to see more older investors sell up as they enter retirement is cause for concern, particularly in light of the rapid population growth Australia is now experiencing.

Source: realestate.com.au