The fastest pace of interest rate hikes in three decades is adding an extra layer of pressure to Australia’s already critical rental market, as a new report reveals tenants are living through the longest stretch of continuous rental price growth on record.

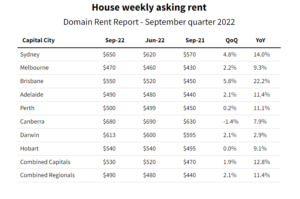

Domain’s Rent Report for the September quarter, released on Thursday, found rent prices have reached record levels across the nation. House rents have risen for the sixth consecutive quarter and unit rents for the fifth, posting their highest growth ever, both annually and quarterly.

The report shows that Brisbane is feeling the brunt of the hefty rental rises, continuing its record-breaking streak with a 5.8 per cent increase in house rental prices over the quarter, and the steepest annual increase on record at 22.2 per cent.

Prices also hit record highs in Sydney, Melbourne, Adelaide, Perth and Hobart. Only Canberra – the country’s most expensive capital city in which to rent – saw a slight fall in its rental asking price.

Source: Domain, powered by APM, QoQ: Quarterly change, YoY: Annual change

Ongoing interest rate rises – the latest October rate rise of 0.25 per cent was the sixth hike in a row – are not the reason Australia’s rent prices are so high, experts say, but they are exacerbating an already critical situation.

“What we need to be clear about is the fact that rents were rising prior to the current increases in interest rates,” says Nicola McDougall, chair of Property Investors of Australia (PIPA). “The reason why prices have been rising so strongly is the critical undersupply of rental properties available around the nation.

“And now we also have a rising interest rate environment, which I’m sorry to say will actually put further upward pressure on rental prices.”

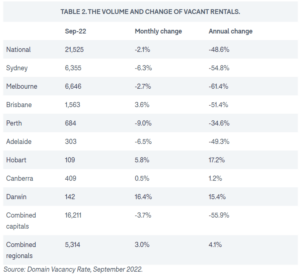

The latest vacancy rate data from Domain lays bare Australia’s rental supply problem: nationally, the number of vacant properties has hit a record low.

National vacancy rates held at their lowest point on record during September, at 0.9 per cent, with vacant rental listings 48.6 per cent lower annually.

Domain chief of research and economics Dr Nicola Powell says while that severe lack of supply is driving up rental prices, multiple interest rate rises also give investors “solid ground and reasoning” to pass some of that cost onto tenants and raise the rent.

“We’ve seen aggressive interest rate rises from the RBA, and so the cost of holding a mortgage for investors has escalated, so there will be some [impact],” she says.

Although the cost of renting has gone up – house rents in Sydney have increased by $80 a week over the past 12 months, for example – the rises aren’t likely to stretch to cover the increased mortgage repayments investors have been hit with.

An investor on a variable loan with a $500,000 debt will have had their monthly repayments increase by $742 since the interest rate rises began back in May. That investor would have to up a tenant’s rent by $171 a week to cover that increase.

But while investors across the country are likely to be affected by rate rises, not every owner will feel the impact equally, Powell says.

“It depends upon the area, because we saw inner-city areas – and particularly unit rents – impacted more during the pandemic because of the turning off of the tap of overseas migration from students,” she says.

“So while I think [rate rises] will have some effect, I think it depends upon the region and depends upon the area. It depends upon whether any investor is positively or negatively geared.”

The silver lining for tenants is that landlords don’t have the ability to ramp up rents “whenever they like” and have to follow the Residential Tenancies legislation in their state or territory, McDougall says.

Yet, for investors, there’s nothing in place to help cover the costs of the interest rate rises aside from increasing rent for tenants.

Although landlords and investors are likely feeling the pressure to keep rental prices at a reasonable level while keeping their heads above water, there are some actionable steps that can be taken to mitigate the impact.

“Look at refinancing as a way to manage repayments and find a competitive rate.” says Domain Home Loans chief executive Kareene Koh. “By exploring options, it opens up the possibility of savings to be made on a home loan.”

It’s important to weigh up if missing a month or two of rental repayments as a result of increasing the rent and thereby losing a tenant is worth the risk and possible financial loss, Koh says.

“Another consideration is to look at property management and maintenance costs to ensure the landlord is not over-investing in their property, as well as considering working with an agent to balance rental and maintain a secure and stable tenant,” she says.

Keeping rents in line with the current market is important, but if landlords have a good, loyal tenant, maintaining continuity of income and minimising gaps between rentals could outweigh the gains, Koh says.

Source: domain.com.au