New research reveals some homeowners preparing to sell in a slowing market could be at risk losing out on tens of thousands of dollars with a single decision.

PropTrack has released a report examining the financial impact of selling a home off-market, compared to those listed on realestate.com.au.

“Deciding to sell off-market may come at a significant cost to sellers,” PropTrack senior economist and the report’s author Paul Ryan said.

“While some sellers might try to save money by not advertising online, this analysis shows the potential earnings lost in the final sale price far outweighs the initial cost of advertising – particularly in a market with prices falling.”

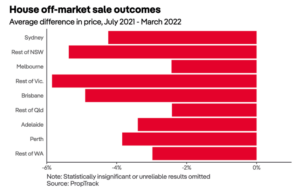

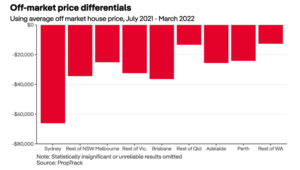

PropTrack examined results from July 2021 to March 2022, and identified the losses incurred by vendors whose transactions were conducted off-market.

It found that houses not listed on realestate.com.au sold for 3.8% less on average than those advertised on the platform.

Vendors in New South Wales fared worst of all when selling off-market, with Sydney house sales achieving 4.2% less than listed sales, equating to a whopping $60,000.

Research reveals the significant potential cost of selling a home off-market. Picture: Getty

Meanwhile, in Melbourne, selling off-market resulted in a 2.4% average loss, or potentially $25,000 for houses, the research found.

Ian Dempsey from Ray White in Preston recently sold a home in the Melbourne suburb for $1.524 million after running a traditional campaign on realestate.com.au.

The property had previously been seeking buyers off-market and attracted offers between $1.2 million and $1.3 million.

“We encouraged our vendors to list their home to drive competition and reach a wider pool of potential buyers,” Mr Dempsey said.

“We went from six inspections off-market to 224 inspections across the period of the campaign, driving the price up in only four weeks.”

In the end, the vendors pocketed $220,000 more than they would’ve if they persisted with their risky off-market strategy.

“Choosing to advertise a property for sale online has never been more important than in this current property market,” Mr Dempsey said.

“With home prices falling, a strong marketing campaign can be the difference between securing the best price possible and settling for a price below a vendor’s expectations.”

Every capital city examined saw off-market house sales deliver worse results compared to properties listed on realestate.com.au, Mr Ryan said.

Brisbane sellers who go off-market at risk of losing 4.9% or $36,000 on average, while vendors in Adelaide and Perth copped about a $25,000 loss, equating to 3.9 and 3.8% less respectively.

House sellers in regional New South Wales wore a 5.3% average loss, equating to $34,500, while those in regional Victoria made 5.8% less, or $32,500.

“The average loss from selling off-market is often tens of thousands of dollars, far more than typical listing costs,” Mr Ryan said.

The research also found that homes within a particular price range incurred larger losses when sold off-market.

Those in suburbs with median house prices between $500,000 and $750,000 performed the worst nationally when transacted off-market, Mr Ryan said.

“In these areas, off-market sales achieved 4.2% lower sale prices,” he said.

“The volume of sales between the $500,000 and $750,000 price points is significant in the market. More than a third of house sales over this study period sat within this price bracket.”

Source: www.realestate.com.au