Home buyers increasingly see it as a good time to buy a home despite predictions that property prices will continue to rise this year, according to the latest data from realestate.com.au.

According to the latest Residential Audience Pulse Survey, 40% of buyers are concerned that property prices will increase in the next six months.

This marks a significant uptick of 6% compared to the survey conducted in September 2023, reflecting a growing apprehension among potential buyers.

This is in line with expert predictions across the industry, with PropTrack economists expecting between 1% and 4% growth in the next 12 months.

Despite these concerns, 35% of respondents believe that it is currently a good time to buy, up 9% on the previous quarter.

More buyers believe home prices will rise this year. Image: Getty

This suggests that while apprehensions exist, many buyers remain optimistic about market conditions.

Digging deeper into buyer motivations, the survey highlights that 23% of Australian consumers aged 18 and above are actively looking to buy.

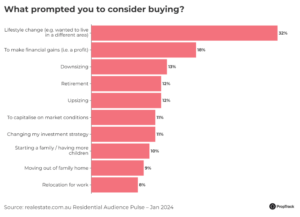

The reasons for purchasing vary, with lifestyle changes such as a desire to live in a different area ranking highest at 32%. Other motivators include making financial gains (18%), downsizing (13%), retirement (12%), and upsizing (12%).

Additionally, 11% of buyers aim to capitalise on market conditions, demonstrating a strategic approach to property acquisition.

Interestingly, the survey also explores perceptions about buyer demand in the coming months, revealing that 32% of buyers anticipate an increase in demand.

While this represents a slight decrease of 4% compared to the previous quarter, it suggests an overall stability in how buyers see the current market.

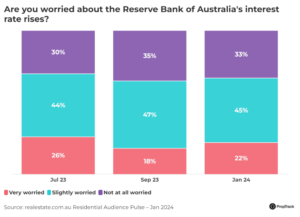

Another concern addressed by survey respondents relates to interest rate rises in the coming months.

The November 2023 rate rise has fueled increased concern from buyers, with 22% feeling ‘very worried’.

However, 33% were not worried at all.

The latest data from realestate.com.au indicates a slight shift in buyer sentiment, with price growth and concerns about future rate rises being top of mind.

Despite this, a significant number of respondents believe it’s a good time to buy, showing a mix of apprehension and optimism.

Source: realestate.com.au