The housing market has been unexpectedly resilient this year in the face of significant increases in mortgage interest rates.

After a turbulent 2022, property prices had been expected to continue falling this year, but this has not been the case.

Sales volumes rebounded early in 2023 and remain strong, and prices have risen every month as limited stock on market has heightened demand.

With September marking the start of the spring selling season and conditions stronger than at the start of the year, this spring looks set to be busy.

Here are the trends shaping the property market.

More properties for sale

We know that spring typically sees an increase in new listings, however, spring last year never sprung.

Fast forward to this year and new listings in Sydney and Melbourne started to lift well before spring, after being persistently low for around a year.

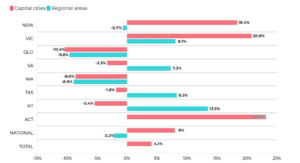

Change in new listings on realestate.com.au in August 2023 compared to August 2022

We expect momentum in market activity to continue in Sydney and Melbourne, at least initially.

It will be important to monitor whether the lift in new listings in Sydney and Melbourne carries through the entirety of spring or if new listing activity slows before the end of the selling season, given it kicked-off earlier.

Interest rates at, or near, peak

Borrowers have faced rapidly rising interest rates since May of last year, however, official interest rates have remained unchanged over the past three months.

It’s likely rates are at or near their peak, though they may still rise again in the future.

For people buying or selling real estate, the pause in interest rates affords more certainty.

Even though borrowing costs have significantly increased, certainty around mortgage costs is likely to increase the willingness of buyers and sellers in this market, boosting activity.

More favourable conditions for buyers

Property prices were expected to fall throughout this year given borrowing capacities have reduced by around 30% since the interest rate hiking cycle began, but that has not come to fruition.

Instead, we have seen a low volume of stock for sale, a significant increase in sales activity and more people actively looking to purchase.

More properties are hitting the market this spring, potentially slowing price growth as the supply and demand ratio rebalances. Picture: Getty

If supply increases, this could result in slower price growth or even some price falls.

More stock for sale means more choice for buyers and potentially less urgency to purchase, especially if buyers are expecting more options will come to market over the coming months.

Housing affordability to worsen

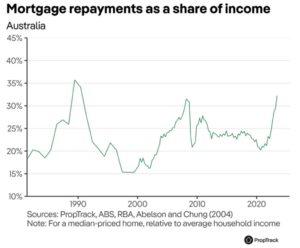

National housing affordability is at its lowest level since 1995, and with many homeowners still rolling-off fixed-rate mortgages at around 2% and resetting to mortgage rates closer to 6%, they will have to dedicate a lot more of their income to servicing their mortgage.

For some borrowers this significant increase in mortgage repayments may result in them having to sell their properties.

Home prices are broadly expected to continue climbing this year, diminishing the supply of cheaper housing and further deteriorating affordability.

Will rents continue to climb?

Although rents have increased substantially over the past year in most major capital cities, the rate of rental price growth has been slowing over recent months.

It’s unclear if rental affordability has stretched too far to rise further or if this slowing is temporary.

During the pandemic, average household sizes shrunk and people flocked to houses over units. Fast forward to today and the gap between the cost of renting a unit and a house remains wider than it was pre-pandemic.

Given this, renters are likely to look for cheaper alternatives which initially may be a unit but may end up being a share house.

Rents will likely continue to climb across the major capital cities but not to the magnitude that they have been rising over the past year. Furthermore, we may continue to see rental growth for houses lag that of units.

Source: realestate.com.au