Melbourne has long been one of Australia’s strongest property markets alongside Sydney, thanks to its robust job market, high migration from overseas and interstate, and its reputation as one of the world’s most liveable cities.

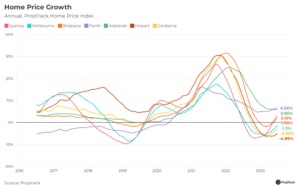

However, in recent years home value growth in Melbourne has slowed while other cities continue to experience strong growth.

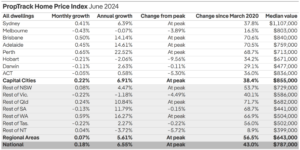

For the first time in 14 years, Brisbane’s median home value surpassed Melbourne’s in March, overtaking Melbourne as the second most expensive city in Australia.

PropTrack’s automated valuation model (AVM) showed that Brisbane’s median house values grew by 4.4% during the quarter, compared to 0.1% in Melbourne.

For units, Brisbane values grew by 7.4%, while Melbourne experienced a decline of -0.1%.

By June, Brisbane’s house value reached $951,000 compared to Melbourne’s $912,000, while Brisbane’s unit value was $633,000 against Melbourne’s $619,000.

This is not a new trend. Melbourne’s year-on-year growth has been minimal at 0.3% for houses and 0.2% for units, whereas Brisbane has experienced house value growth of 14.7% and unit growth of 20.3%.

Both Adelaide and Perth have also experienced strong growth over the past 12 months, suggesting that house and unit prices in these cities could surpass Melbourne’s if these trends continue.

So, why is Melbourne struggling to achieve the home price growth seen in other cities?

Firstly, many of Melbourne’s issues stem from the pandemic, which hit the city harder than others.

Melbourne lost more of its population to interstate migration and faced closed borders, which led to many investors leaving the market due to low demand for rental properties in the inner city.

While cities less affected by lockdowns, such as Brisbane, Adelaide, and Hobart, attracted interstate migrants and boosted their property markets, Melbourne (and to a lesser extent Sydney) struggled to recover from the pandemic’s impacts.

Home price growth in Melbourne remained sluggish throughout 2021. And by the time the first interest rate hike occurred in 2022, Melbourne was already behind other cities in price growth.

As of June 2024, Melbourne’s prices were 3.89% lower than their previous peak before the most recent downturn. In contrast, Sydney, Brisbane, Adelaide, and Perth had already surpassed their previous highs to reach new price peaks.

Melbourne’s slower recovery has made sellers more hesitant to list their properties, further slowing down the market’s recovery.

According to realestate.com.au’s most recent Residential Audience Pulse survey, only 19% of Victorian respondents considered it a good time to sell a property, compared to 37% in Queensland and 25% in New South Wales.

Higher interest rates and a higher cost of living have reduced borrowing power, making buyers more reluctant to purchase in the current environment. This has led to more subdued auction clearance rates compared to the same time last year.

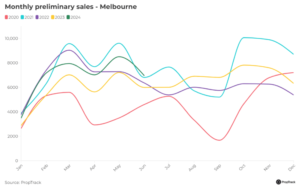

Nevertheless, buyers are still purchasing properties, and sales figures for Melbourne in June were up 16% compared to last year.

However, buyer expectations have been tempered by reduced borrowing power and a more cautious view of the property market and economy, making them unlikely to pay the high prices seen in more prosperous times.

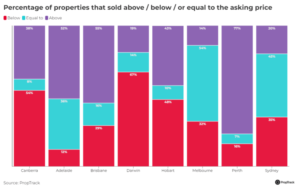

In June, over half of the properties sold in Melbourne went for the asking price, more than one-third sold for less, and only 14% sold for above the asking price.

In contrast, over half of the sales in Brisbane and Adelaide went for more than the asking price, and in Perth, 77% exceeded the asking price.

This conservative behavior among Melbourne buyers partly explains the city’s lower median price growth compared to other cities.

Despite this, it does not indicate that Melbourne’s property market is faltering. Buyers and sellers are still active, and most market indicators remain positive.

It is more likely that Melbourne is simply undergoing a period of adjustment, with prices normalising after decades of strong growth.

Source: realestate.com.au