As Australia’s housing supply crisis drives up rents and new home prices, there are fears that pricey housing costs could keep inflation and interest rates higher for longer.

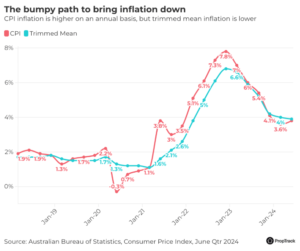

The latest inflation data released by the Australian Bureau of Statistics (ABS) on Wednesday showed the Consumer Price Index (CPI) rose 1% during the June quarter, and 3.8% over the year.

The result was lower than what economists at most of the big banks had expected and was broadly in line with the Reserve Bank’s forecasts, easing expectations of a rate rise at the RBA’s next board meeting next week.

However, housing inflation grew 1.1% during the June quarter and 5.2% over the year to June, well above the 3.8% average annual inflation rate.

Housing inflation was driven by a 7.3% rise in rents and a 5.1% increase in prices of new homes purchased by owner-occupiers during the 12 months to June.

“Inflation will remain too high if we don’t get a circuit breaker from government to facilitate the building of more homes for both owner-occupiers and renters,” Master Builders Australia chief executive Denita Wawn said.

“The housing shortage makes it difficult to contain inflation.

Housing inflation increased 5.2% over the year to June, driven by higher rents and new homes prices. Picture: Getty

“This puts pressure on the Reserve Bank to lift interest rates, leading to even higher rental inflation and less building activity.”

However, PropTrack senior economist Paul Ryan said housing inflation wasn’t the main feature that the RBA would be looking at when determining interest rates.

“The RBA looks at housing inflation closely, but they also know that it reflects changes in market conditions that have already happened,” Mr Ryan said.

“While it does reflect broader demand pressures across the economy to some extent, I think the RBA is cognisant that changes in interest rates now are not going to change the path of rents that are measured by CPI because there’s so much impact from changes in advertised rents that have already happened.”

Tough rental conditions persist

Australia’s rental shortage has fuelled strong rental growth across the country in recent years. It had shown no signs of abating until recently, with advertised rental growth slowing down and rental vacancy rates edging higher over the past few months.

National weekly rents remained unchanged during the three months to June, but did increase 9.1% year-on-year to $600 per week, according to PropTrack.

At the same time, the national vacancy rate increased to 1.4% in the June quarter, up from 1.1% in the March quarter.

It comes as property investors appeared to be returning to the market, increasing the supply of rental homes available and easing the pressure on renters.

The number of new loan commitments to investors was 24% higher during the first five months of 2024, compared to the same period last year, according to the ABS.

Mr Ryan said it was by no means a good market for renters yet, but things were starting to move in the right direction.

“The RBA will be relieved to see the rental market is starting to move very slightly in the right direction, and so will renters for that matter,” Mr Ryan said.

Home building remains challenging

Mr Ryan said the return of property investors may be also a positive sign for new home building since investors needed to purchase homes for renters to live in.

Home building approvals fell 8.5% across the country during the 12 months to June. Picture: Getty

“While current data on new housing construction is still quite weak, I think these are the preconditions for housing construction to rebound,” he said.

The latest figures showed home building approvals fell 8.5% nationally during the year to June, marking the slowest financial year for building approvals in a decade, according to the latest ABS data released on Tuesday.

Federal, state and territory governments have set a goal to build 1.2 million new, well-located homes across the country by mid-2029, although there are doubts about achieving this goal.

The five-year target hasn’t started well, with just 162,892 dwellings approved during the 2023-24 financial year – well below the 240,000 new homes needed per year to reach the 1.2 million goal.

Source: realestate.com.au