More home sellers believe it’s a good time to put their property on the market, which has led to an influx of new home listings across the country.

Nationally, there was a 16.6% year-on-year increase in new listings on realestate.com.au in February, while total listings rose 7.2%.

The surge in activity is particularly notable in capital cities, where new listings reached their highest levels since 2012.

It comes as recent data from realestate.com.au’s Residential Audience Pulse Survey underscored the trend, revealing that one in ten Australian consumers were contemplating selling their property.

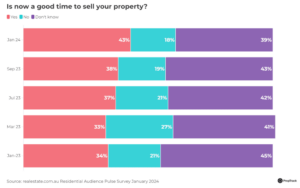

Seller confidence has significantly improved in the past 12 months, with 43% of survey respondents now considering it a favourable time to sell, a notable increase from 34% in January last year.

Western Australia has the highest seller sentiment, with 63% of respondents expressing optimism about the current market, marking a substantial 70.3% increase from last year.

NSW, Queensland, and South Australia have also witnessed substantial growth in seller sentiment over the past year, with NSW up 53.8%.

The primary drivers behind this uptick in seller sentiment were perceptions of rising prices and increased buyer demand.

Over a third of sellers anticipated further price increases in the next six months, paralleled by a similar proportion foreseeing a surge in buyer demand.

Lifestyle changes, such as relocating to a different area or seeking a property with specific amenities like a pool or more space, were the primary motivations for selling.

Main reason for considering selling

Downsizing ranked second, reflecting the preferences of Australia’s aging population seeking properties better suited to their evolving needs.

Respondents aged 65 and over considered downsizing to be their main motivator for moving, whereas upsizing was the main factor for those aged 49 and younger.

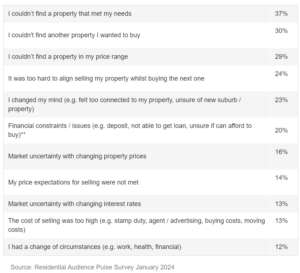

While seller numbers are on the rise, several obstacles hinder property sales presently.

Many sellers cited the difficulty in finding a suitable property to purchase as the primary reason for reconsidering selling, with 67% of survey respondents unable to find a property that they wanted to buy or that met their needs.

Reasons for changing mind about selling

Moreover, finding a property that meets their criteria and falls within their budget remains a hurdle exacerbated by robust price growth over the past year.

Despite these challenges, 43% of sellers express a strong intention to sell within the next six months and this should further bolster new listings volumes.

Home buyers will welcome the uptick in new listings as more options hit the market, but will still face significant competition due to lower-than-normal total listing levels.

Source: realestate.com.au