The US Federal Reserve has voted to lower interest rates by 0.05 percentage points in a sign that the global war on inflation is finally coming to an end.

And the move is expected to be welcome news for homeowners not only in the US, but also in Australia.

In its policy statement, the Fed said the decision reflected “greater confidence that inflation is moving sustainably toward 2 per cent” and that the central bank “judges that the risks to achieving its employment and inflation goals are roughly in balance.”

US Federal Reserve chair Jerome Powell does what every homeowners has been wishing for. (Photo by SAUL LOEB / AFP)

The Reserve Bank of Australia’s inflation target aims to keep consumer price inflation between 2 and 3 per cent.

It is currently 3.8 per cent, with the most significant price rises during the June quarter being housing (+1.1%), food and non-alcoholic beverages (+1.2%), clothing and footwear (+3.1%), and alcohol and tobacco (+1.5%), according to the Australian Bureau of Statistics.

Housing costs continue to be an inflationary sticking point.

But it is generally trending down after jumping to dizzying heights during the Covid 19 pandemic.

And a number of Aussie market experts are now tipping as many as four rate cuts next year, which could reignite another nationwide property boom.

As of September 17, the ASX’s RBA Target Rate Tracker was predicting that the Reserve Bank of Australia (RBA) would hold the local cash rate at 4.35 per cent when the Board meets again on Tuesday, September 24.

“As at the 17th of September, the ASX 30 Day Interbank Cash Rate Futures September 2024 contract was trading at 95.665, indicating a 10% expectation of an interest rate decrease to 4.10 % at the next RBA Board meeting,” the RBA Rate Indicator said.

But Australian financial markets have begun pricing in four interest rate cuts within the next 12 months.

The RBA is expected to first cut interest rates by 25 basis points in February, with three more by August, according to the market expectations.

It’s the first prediction of multiple cuts since the Reserve Bank started hiking rates in May 2022.

The cuts have been predicated on forecast drops in US interest rates, which would raise the value of the Aussie dollar relative to the Greenback and put the RBA in a better position to drop the cash rate.

The RBA’s Official Cash Rate currently sits at 4.35 per cent. The current owner-occupier variable discounted rate sits at 7.07 per cent.

Over to you, Reserve Bank of Australia (RBA) governor Michele Bullock. Picture: NewsWire / Martin Ollman

Four interest rate cuts would bring much needed relief to existing homeowners and prevent many families from needing to sell their properties.

But first-home buyers have been warned that the cuts could do as much harm as good by increasing competition for housing and pushing prices up.

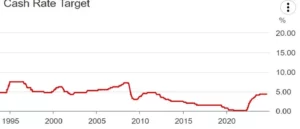

The highs and lows of the Aussie cash rate. RBA

SQM Research director Louis Christopher said four cuts next year, while still a more remote possibility, would cause a huge rebound in property markets that had recently been weaker, including Melbourne and Sydney.

“There is a strong history of rate cuts stimulating housing demand,” he said, noting that new cuts would unleash a lot of pent up demand from buyers.

Many of these buyers had been sitting on the sidelines in recent years waiting for a change in rates, Mr Chistopher said.

Louis Christopher, SQM managing director, says four rate cuts would cause another housing boom

The RBA Target Rate Tracker calculates the probability of changes in the Overnight Cash Rate based upon the implied yields of very short term (30-day) interest rate futures.

It comes as several lenders cut fixed and variable home loan rates for both owner occupiers and investors in early September.

Experts said cuts to fixed rates were often an indication that banks expected variable rates to be lower in the coming months.

Mozo money and finance expert Rachel Wastell said these cuts were likely to continue into September.

“(They) are a reflection of the growing industry confidence that the RBA’s next move is a cut,” she said.

Analysis from comparison group Finder showed that four rate cuts would save the average Aussie homeowners $5,076 per year on mortgage repayments.

Finder head of consumer research Graham Cooke advised hopeful homeowners to bear in mind that the expectations of markets were only a prediction.

“The ASX is clear on its site that the information is indicative only, meaning that while the market may be pricing in the possibility of four rate cuts, this is not a guarantee that the Reserve Bank will take action,” he said.

“The ASX Target Rate Tracker reflects market sentiment based on short-term interest rate futures, but economic conditions can shift quickly. Homeowners and investors should remain cautious.”

Finder head of consumer research Graham Cooke said economic conditions can shift quickly, and homeowners and investors should remain cautious.

My Housing Market economist Andrew Wilson said homeowners should take the ASX predictions with a grain of salt.

“It comes from a speculatory environment. A lot can change between now and next year,” he said.

Mr Christopher said the ASX expectations hinged greatly on what happened in the US. “It’s a big ‘if’. We don’t believe (four cuts) would happen, but if it did there would be a definite rebound. A lot would depend on migration,” he said.

Mr Cooke said four interest rate cuts would change the housing market.

“Many households have been feeling the squeeze following 13 rate hikes – a series of rate cuts would save Aussies hundreds of dollars per month on variable-rate home loans,” he said.

“(But) it’s important to remember that these predictions are based on probability, and the future is still uncertain.”

Mr Cooke added that rate cuts came with a potential downside for those seeking a new home.

“While rate cuts might alleviate some financial pressure on current homeowners, they could also reignite demand in the housing market, potentially driving up property prices again,” Mr Cooke said.

“This would make it harder for first-home buyers to enter the market, even with lower borrowing costs.”

Those on soon-to-expire fixed rates would be among the big winners of a succession of rate cuts, Mr Cooke explained.

“Homeowners on fixed-rate mortgages might not immediately feel the benefits of the cuts. However, those whose fixed terms are ending soon could see better refinancing options when their loans revert to variable.”

Source: realestate.com.au