The number of investor loans has risen over recent months; however, one state is attracting more investors than others.

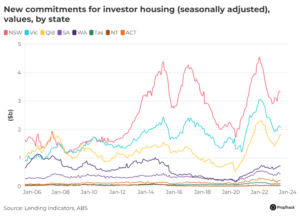

New lending indicators data from the Australian Bureau of Statistics shows that new investor loan commitments rose by 11.6% in value from February to July 2023 nationally.

Although most states experienced growth in new investor loans over the same period, Queensland was significantly higher, with its new loan value increasing by 31% since February.

At almost three times the national level, this growth reflects how popular the state is with buyers looking for investment properties.

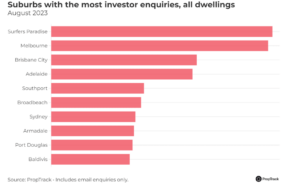

A similar trend is evident when we look at suburb-level investor data.

Of the suburbs with the most email enquiries from investors during August, half were in Queensland.

Surfers Paradise and South Port in the Gold Coast region, and Brisbane City were among the top five most enquired suburbs by buyers who intended to invest. Together they received more enquiries than Melbourne, Adelaide, and Sydney combined.

Surfers Paradise was the most popular suburb among investors in August. Picture: Getty

But what is driving investors to Queensland?

There are a few potential factors.

Queensland remains one of the only states where house and unit median sale prices are below the national median. Currently, national median prices are $735,000 for houses and $565,000 for units, while houses in the state have a median of $670,000 and units $506,000.

In addition, it has recorded the second-highest annual growth in weekly advertised rent among all states, with rents increasing by 13% since September 2022.

Another drawcard for investors is the high rental yield, which is the return on investment minus costs. The median yield in Queensland is 4.8%, higher than the national median of 4.2%.

The recent trends in investor loans may signify that they are re-entering the market after many exited during the pandemic and throughout 2022.

If so, it will be a welcome boost to the tight rental market.

Source: realestate.com.au