Rents flatlined in July and August as rental demand weakens amid slowing migration and affordability constraints forcing a change to household formation.

After rocketing 39% higher between August 2020 and June 2024, CoreLogic’s national rental index has flatlined over the past two months, demonstrating the weakest rental market conditions since the early phases of the pandemic when rents briefly trended lower. For some context, the same period of time prior to the pandemic saw rents rise by just 5.4%.

While rental trends are highly seasonal – with rental growth typically slowing through the middle and end of the year – the annual trend is also slowing. Nationally, the annual pace of rental growth peaked at 9.7% over the 12 months ending November 2021, which was a series high. The annual growth trend has since eased back to 7.2%, the lowest annual growth rate since the 12 months ending May 2021.

Despite the slowdown in annual rental growth, most cities are still recording an annual rental trend that is well above the pre-COVID average. Nationally, rents were rising at the average annual pace of just 2.0% per annum in the ten years before March 2020. The only capital where the annual change in rents has been less than the pre-COVID decade average is Hobart where both housing values and rental trends have been weak.

The slowdown in rental growth is most evident across the unit sector, with the annual change in unit rents nationally reducing from 14% over the 12 months to April 2023, to 6.7% over the most recent 12-month period. The annual pace of house rents peaked much earlier, reaching 10.8% over the 12 months to September 2021 and reducing to 7.4% over the past 12 months.

Perth and Adelaide continue to show the strongest rental growth, with annual gains of 11.6% and 8.4% respectively. However, even these cities are showing a clear slowdown in rental growth, especially Perth where rents increased by ‘only’ 0.7% over the past three months.

Sydney rents fell over the three months to August 2024, the first decline in rents over a rolling three-month period since the three months ending October 2020 amid COVID-related lockdowns. Rents were also down in Hobart (-0.3%) and Canberra (-0.5%).

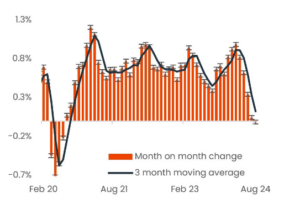

Figure 2. Month on month change in national rental index since 2020

What’s behind the slowdown in rents?

There are several factors at play when it comes to slower rental conditions.

Affordability is likely to be a key factor constraining further rental growth. Between March 2020 and June 2024 Australian wages (based on the wage price index) increased by 12.7% while rents have increased by 36.1%. According to CoreLogic’s latest rental affordability metrics, a household on the median income would be dedicating 32.2% of their gross annual income to pay the median rent, a record high on the series that goes back 20 years.

With rental affordability so stretched, patterns of household formation are once again evolving. Data from the RBA shows the average capital city household reduced in size from around 2.63 residents per dwelling to around 2.53, as group households split during the pandemic. Smaller households had the effect of amplifying housing demand, especially rental demand. While this trend has been slow to reverse, the RBA’s latest estimates show households are once again becoming larger. As group households and multi-generational households become more common and the average household size rebuilds, logically rental demand should ease.

The peak in net overseas migration in the first quarter of 2023 aligns with the peak rate of rental growth across the unit sector in April 2023. Since net overseas migration peaked at a record high of 165,000 in the March quarter last year, the quarterly change reduced to 107,000 in the December quarter of 2023; a drop of around 58,000 net overseas migrants to Australia. While net overseas migration was still about 1.6 times higher than the pre-COVID decade average for the December quarter, it’s a sharp drop from the record high levels of migration. Overseas arrivals data points to an ongoing slowdown in foreign student arrivals, implying the net overseas migration slowdown has further to go. With approximately 90% of net migration to Australia arriving on temporary visas, the flow through to rental demand is direct and immediate. Less migration helps to explain a further reduction in rental demand.

Peripheral factors in the rental slowdown could include the ongoing completion of new dwellings related to the HomeBuilder program and a pickup in investment activity supporting rental supply.

The HomeBuilder grant, which was available between June 2020 and mid-April 2021 saw a surge in dwelling approvals, with commencements subsequently peaking in the June quarter of 2021 at 66,400. Materials shortages, capacity constraints and cost blowouts have seen a significant lag in delivering this stock through to completion and have likely resulted in a prolonged period of renting for many of those waiting for their new home to be completed. As more new builds settle, we should see a gradual diminishment in rental demand associated with building delays.

Investor activity has been on the rise, with the volume of lending to investors rising 10.7% over the year to June and the value of lending rising 30.2%. Investors play a key role in delivering rental supply to the market which may be supporting an alleviation in supply-side pressures.

Source: corelogic.com