Melbourne house values have increased a mere 1.6% between the onset of COVID in March 2020 and the end of May 2023. Every other capital city has seen double-digit growth, ranging from a 16.5% gain in Sydney to a 45.2% surge in Adelaide house values during that period.

Melbourne home owners might be disappointed at the city’s substantially lower growth rate but for home buyers the sluggish conditions could give Melbourne an attractive affordability advantage.

Capital city price rivalry

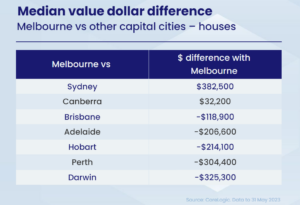

The legendary rivalry between Melbourne and Sydney goes well beyond friendly barbecue banter dating back to the 1850s but when it comes to house prices, Sydney has always had the upper hand. In March 2020, at the onset of COVID, Melbourne house values were 19.2% cheaper than Sydney’s. By April 2022 the gap between Sydney and Melbourne house values had blown out to 30.3% – the biggest divergence since May 2006. The gap has closed a little since then however Melbourne’s median house value was 29.6% behind Sydney’s in May 2023, or the dollar equivalent of roughly $382,500.

Every capital city other than Canberra – the country’s second most expensive capital for houses – has significantly closed the house value gap to Melbourne. At the onset of COVID, Brisbane houses were 47% cheaper than Melbourne. That affordability gap has closed to just 15%.

Melbourne was 85% more expensive than Adelaide at the start of COVID but the gap has narrowed to just 29% and in Perth, where the gap was 88%, Melbourne house values are now 50% higher.

Less substantial swings and roundabouts

The under-performance of Melbourne house values relative to other capital cities is due to a combination of factors. The city experienced a more substantial drop in value than other capitals through the early stages of COVID, it recorded a softer increase through the upswing and there’s been a significant decline in values through the rate hiking cycle to-date.

Melbourne house values fell by -6.7% between March 2020 and October 2020, before surging 20.6% through the growth cycle. House values subsequently fell by -11.2%, finding a floor in February this year. Since February, Melbourne house values have risen by 1.7% to the end of May 2023.

Melbourne’s road to recovery

Melbourne’s softer housing market conditions through the pandemic cycle coincided with a sharp drop off in demographic trends. Both net overseas and interstate migration rates fell sharply through the pandemic, reaching record lows, detracting from housing demand amid a series of lockdowns associated with the pandemic.

Demographic data to September 2022 shows Victoria’s interstate migration is normalising and was almost back in positive territory (-484 net interstate migrants). With demographic data for Q4 2022 to be released later this week, it’s likely Victoria will be once again have reached a positive interstate migration position, putting an end to 10 consecutive quarters of decline.

With Australia’s annual net overseas migration surging to new record highs and Victoria’s first possible rise in interstate migration since Q1 2020, housing demand across Melbourne has begun to strengthen substantially.

Melbourne’s competitive edge

With housing affordability remaining stretched, this improvement in Melbourne’s value proposition could place Australia’s second largest city in a more competitive position to attract a greater share of housing market participants.

The city’s advertised supply level is trending lower and is -13.4% below levels at the same time last year and -7.0% below the previous five-year average.

Melbourne’s rental vacancy rate of 0.8% in May is also one of the lowest in the country and yet another potential factor supporting purchasing demand for those with the financial capacity to enter the market.

Melbourne blinder not guaranteed

Whether Melbourne’s strong demand, low supply and a relative affordability advantage can completely offset the impact of high interest rates remains uncertain. Demand from overseas migration is likely to remain a feature of the market for the next few years, however borrower’s access to credit will be challenging while interest rates are high.

Additionally, it’s possible more home owners choose, or need, to sell due to the substantial increase in mortgage repayments over the past 13 months alongside persistently high cost of living pressures. Any marked rise in new listings could add downwards pressure to housing prices.

Source: Corelogic.com.au