Changes to land tax thresholds in 2024 increased costs significantly for investors in Victoria, but how many of them have responded by selling their rental properties?

Analysis comparing the number of rental properties sold to those in other states suggests almost 5,000 more investors have sold up since the changes were announced.

Over the longer-term, this is likely to contribute to less new housing construction in Victoria.

Land tax thresholds changed as part of the COVID levy

As part of the budget announced in May 2023, the Victorian government reduced the threshold for land tax payments for investment properties as part of the temporary COVID debt levy. The lower threshold ($50,000 compared with $300,000) applied from January 1, 2024.

This caused an annual cost increase for investors in Victoria amounting to $1,175 on an unimproved land value of $500,000. In total, this was expected to hit almost half a million investors and raise $4.74 billion over four years.

The changes have been cited as a key reason for many Victorian investors selling investment properties.

Victorian property investors have criticised the state government’s decision to increase property taxes. Picture: Getty

How many investors have sold?

By tracking homes advertised to rent on realestate.com.au, we get a good indication of which homes investors are buying, and when they sell.

As a share of all rental or investment properties, just under 6% of rental properties were estimated to be sold over the past year across the whole country.

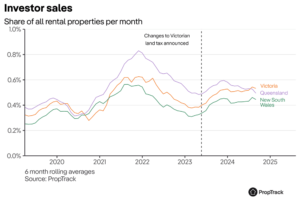

In Victoria, the share of rental properties being sold has increased following the announcement of the land tax changes – but so have rates of investor selling in New South Wales and Queensland.

Clearly other factors such as market conditions also influence investor selling behaviour. That is why it is difficult to causally identify the impact of the changed land tax regime in Victoria.

For this reason, I constructed a differences-in-differences regression model to estimate the impact of the change in Victoria.[1] Simply, this technique identifies the impact of the change by comparing the differences between a Victorian investor selling and those in New South Wales and Queensland before and after the changes were announced.

The results of this model suggests there has been a statistically significant increase in the share of investment properties being sold in Victoria since May 2023.

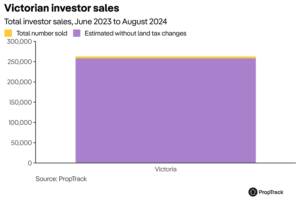

In total, the difference amounts to around 4,900 more investment homes sold than the estimated counterfactual where no land tax changes were made. A sizeable number, but just under 2% of the total number of investment properties we have tracked that have been sold over the period, and around 0.75% of the total number of rental properties.

This analysis assumes that without the land tax changes, selling activity across the states would display the same relative trends as before the announcement. However, it is worth noting that market conditions have evolved quite differently across states over the past year – with price growth in Victoria markedly lower than elsewhere.

In addition, it is worth noting that some of these sold investment properties will have been bought by new investors. The overall effects on the market will therefore depend on how this change impacts other investors and first-home buyers.

New investment appears to have slowed

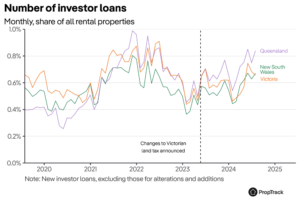

On the other side of the ledger, higher land taxes look to have led to fewer new investors buying properties across Victoria.

As a share of existing rental properties, loans to investors for new or existing homes in Victoria were tracking at a similar pace to those in Queensland, but since the announcement have fallen behind.

How has increased investor sales impacted the rental market?

With rents increasing 9.5% in Melbourne over the past year, there has understandably been concerns about the impact on renters of reduced incentives for investors to provide rental accommodation.

There are three key effects of increased investor selling.

The first is on the balance between first-home buyers and investors. Sold rental properties do not disappear and when bought by first-home buyers reduce rental demand and supply by the same amount. But reduced competition from investors is likely to make the jump to first-home ownership a little easier.

There is some evidence first-home buyers have increasingly had the edge in Victoria since the land tax changes were announced.

The second impact is on home prices. More investors in Victoria selling properties as well as new investors requiring higher yields to compensate for higher costs implies lower prices. This has likely played a small part in slower price growth in Victoria over the past year.

The third impact will be on long-term construction. Investors are key for the viability of many construction projects, particularly high-density projects which require pre-sales many years before completion. Lower investor activity is likely to limit the number of projects that are able to be built across the state over the coming years.

While current conditions for first-home buyers appears promising in Victoria, lower investor activity and construction may lead to dwelling shortages and higher prices and rents over the longer-term.

Source: realestate.com.au