As the property downturn spreads across more Australian housing markets, both buyer and seller activity has softened.

However, demand for housing finance across owner occupiers that are not first homebuyers (i.e., subsequent buyers defined as upgraders, movers and downsizers) appears to be fairly resilient in the rising rate environment.

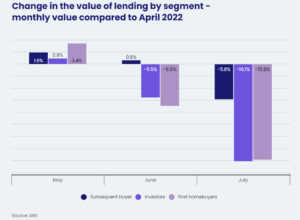

Using ABS housing finance data to July, we can see how different buyer cohorts are reacting to the market downturn. Figure 1 compares the value of housing finance secured for the three main buyer classifications: first homebuyers, subsequent buyers and investors.

The chart shows housing finance secured by each group relative to April 2022, when national home values peaked. Since the rate tightening cycle started in May, investors and first homebuyers have seen much faster declines in housing finance secured than subsequent buyers.

This may be because subsequent buyers are less sensitive to lifts in interest rates. Using the sale of an existing home to fund their next home purchase, subsequent home buyers would likely need to take out less debt than first homebuyers, thus being less affected by rate rises.

Meanwhile, investors are likely to be more sensitive to a lift in rate rises. Although investors can offset the expense of higher interest rate payments as a tax deduction, investors are typically more leveraged than owner occupiers, and have inherently higher mortgage rates.

How have buyer cohorts behaved in the past?

Figure 2 looks at how lending volumes among the different cohorts have changed amid historic downturns since 2004 (where the ABS lending data series commences 2003).

The main difference between the buyer types over historic downswings is that first homebuyer demand for finance has traditionally been more resilient through downswings, with subtler declines in demand, and during some periods, increases. Subsequent homebuyers and investors have seen a more distinct decline in demand for housing finance initially through downswings.

The reason first homebuyer borrowing has held firm or even risen through downswings is two-fold. Firstly, government incentives for first homebuyers were introduced through some of these declines. Notably, the ‘First Home Buyer Boost’ from October 2008 to December 2009 provided up to an additional $14,000 for eligible first homebuyers. With unlimited numbers for the scheme, the boost to the first homeowner grant led to the biggest monthly surge in loans secured for first homebuyers on record, at 16,753 loans secured in the month of April 2009.

The second reason is price falls lower the ‘deposit hurdle’ for first homebuyers. The deposit hurdle is an issue largely confined to people purchasing real estate for the first time, and as property prices fall, this initial savings hurdle for first homebuyers also falls.

Outlook for buyer segments

First homebuyers. For first homebuyers this downswing is shaping up a little differently. That’s because the current downswing has largely been the result of higher mortgage rates, which impacts housing affordability (from the perspective of paying off a mortgage). As recently noted in the CoreLogic ANZ Housing Affordability Report, mortgage repayments for first home purchases may actually be higher than what they were when values peaked in April, due to the cash rate rising 225 basis points since then.

First homebuyer activity may lift through the downswing if there are any special new grants or incentives that come into play over the course of the decline. Though there are ongoing schemes available such as the ‘Help to Buy’ program and the ‘First Home Guarantee’, these schemes are unlikely to create the rush in first homebuyer demand that temporary schemes have done in the past. This is because the current first homebuyer programs in place have limitations on the number of places per year, and income caps.

Investors. For investors, we would expect demand to pick up longer term when there is more certainty around the trajectory of mortgage rates and price declines start to flatten out. This is because rental market conditions remain strong, with more rental demand expected as overseas migration returns. Gross rental yields are trending higher as rents rise in most cities while housing values trend lower.

Subsequent buyers. Subsequent buyers will continue to dominate the mortgage and purchasing market. Historically, subsequent buyers have accounted for around 48% of monthly borrowing for home purchases, and over the short term could make up a greater-than-usual share of transactions as first homebuyer and investor demand is more sensitive to increased mortgage rates. As mentioned previously, subsequent purchasers don’t face the same deposit hurdle as first homebuyers, and the significant amount of equity some owners may have accumulated over the past few years could be the catalyst for some to trade up, downsize or relocate. But even this relatively resilient buyer segment is likely to see a gradual decline in activity, as long as interest rates are rising.

Source: corelogic.com.au