Traditionally, spring is a time of fervent activity for the Australian property market as sales and listings increase. However spring 2022 is expected to hit a little differently amid higher mortgage rates, weak consumer sentiment, stretched household budgets and weaker buyer interest.

Using the latest data and insights from CoreLogic, we’ve compiled five key trends for you to be across this spring selling season.

1. New listings and auctions will rise in the coming weeks

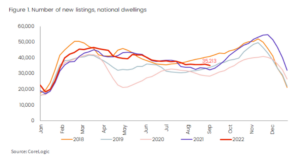

‘New’ listings are the freshly advertised properties for sale, where the start of the campaign was in the past 28 days. To avoid counting ‘re-‘listings’, a new listing will be excluded if it was also listed within the past 75 days). New listings are the flow of properties added to the market, or the new properties popping up when you refresh a listings page. Figure 1 shows the rolling count of new listings added to the market through 2022 every 28 days, compared with the four years prior.

In the 28 days to September 4th, there were 35,213 new listings advertised across Australia, which is higher than the equivalent period in 2021, 2020 and 2019.

Despite new listings counts still trending lower, there are some data points that indicate a lift is on its way in the next few weeks. For example, ‘CMA activity’, which is a count of the Comparative Market Analysis reports generated across CoreLogic’s RP Data platform, is a leading indicator of rises and falls in listings volumes. In the final seven days of August, CMA volumes rose 8.2%, indicating that the seasonal lift in new listings is about to take off.

The lift in listings is also expected to flow through to the auction market, where the number of properties going under the hammer across the combined capital cities typically lifts from September, and continues rising through to the start of December. Figure 2 compares the rolling 28-day count of scheduled auctions through 2022, alongside 2021 and the five-year average prior to COVID. Auction volumes may follow a more ‘normalised’ trend than in 2021, more closely aligned to the pre-COVID average.

2. The seasonal uplift in new listings will vary between regions

In the five years prior to the pandemic, new listings campaigns nationally have increased 19.6% on average between winter and spring. The seasonal bump varies between cities, with cooler climate areas like Canberra (42.4%), Adelaide (33.7%) and Hobart (31.6%) typically seeing a larger seasonal effect than more temperate markets. A summary of the average seasonal uplift of the major regions and capital cities is summarised in figure 3 below.

Figure 4 provides a more granular, Local Government Authority (LGA) view of which markets see the biggest uplift in new properties advertised between winter and spring. Between 2015 and 2019, the volume of new listings added to the market has on average doubled across Adelaide Hills in this period. In addition, many regional, lifestyle areas like the Mornington Peninsula, Yass Valley, Surf Coast and Huon Valley see a notable uplift in new listings through spring.

Given home values across Adelaide have only just passed a peak in value, many sellers across the city may show interest in ‘cashing in’ this spring selling season. Despite a -0.1% fall in the CoreLogic Home Value Index for Adelaide, values are still almost 45% higher since the onset of COVID in March 2020.

3. It won’t be the bumper spring selling season we experienced last year

2021 had a particularly ‘bumper’ spring selling season, which is unlikely to be replicated this year. CoreLogic estimates there were 154,294 new listings added to the market through spring 2021, higher than the previous decade spring average of 144,985. Late 2021 also saw record-breaking auction volumes, with the highest count of auctions on record over the week ending December 12th (4,981).

More listings were likely concentrated at the end of 2021, because rising COVID cases and extended lockdowns across parts of the country would have made it difficult to sell from June to early October. In other words, sellers were playing ‘catch-up’ as pent-up demand from vendors was unleashed once lockdowns ended. In addition, annual capital growth rates averaged 21.3% nationally through spring last year, creating a big incentive for vendors to ‘cash in’ on price booms.

Coming into spring 2022, market conditions are very different. Buyer appetite is falling against higher interest rates, properties are taking longer to sell, and vendors are having to offer greater price discounts in order to get deals done.

4. Long-term owner-occupiers more likely to sell

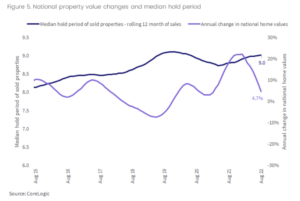

An interesting feature of a housing market in decline is average hold periods of sold properties rise. This phenomenon is seen in figure 5, which shows the median hold period of national sales over a rolling 12-month period, compared with the annual change in dwelling values. Twelve-month hold periods have been elevated amid the current downturn, as well as the downturn from 2017-2019.

This is because recent buyers are at more risk of making a nominal loss if they sell during a downturn. Meanwhile, those who have held their property for longer are more likely to have made nominal gains, even if the market is going through a short-term, cyclical downswing. Recent research by CoreLogic suggests home values have generally trended higher over time, and increased more than 380% in the past 30 years. Meanwhile national home values are sitting just 4.7% higher over the past 12 months, with annual value changes likely to hit negative territory over the course of the cycle. 5. Sellers will have to listen to buyer feedback, and be flexible on price

5. Sellers will have to listen to buyer feedback, and be flexible on price

While both buyers and sellers become more active during the spring selling season, this doesn’t make it a seller’s market. Properties are taking longer to sell, with median days on market up to 33 days in the three months to August, which has increased from a low of 20 days in November last year. The discounts between initial listing prices and contract sale prices (otherwise known as ‘vendor discounting’) has also become larger as shown in figure 6, with the median discount sitting at -4.0% nationally. Similarly, auction clearance rates across the major auction markets are consistently below average.

Serious vendors will need to be realistic about their price expectations and ensure they have a quality marketing campaign behind the property in what is likely to be a more competitive selling environment through spring and early summer.

This reduction in price is largely a function of rising mortgage rates, where buyers may not be able to afford as much debt as they could a few months ago. The average owner-occupier home loan size has fallen nationally, from a recent high of $617,608 in January of 2022, to $609,043 in July. As the cash rate is expected to rise further in the coming months, borrowers may become more constrained.

Source: CoreLogic