In this article, CoreLogic Head of Research Eliza Owen addresses the debate on Australia’s migration strategy and shares five key insights on overseas migration and the housing market.

Overseas migration is frequently being called out as one of the primary factors influencing the housing market. In the face of high interest rates, low consumer sentiment and stretched housing affordability, values and rents continue to rise and vacancy rates plummet as net overseas migration has hit record highs.

National home values have increased 7.2% in the year-to-date, and rent values rose 6.0% in the same period. Heated discussions around migration are drawing more focus as housing affordability worsens. But there are many other factors driving values and the rental market, and long term, strategic migration policy should not be influenced by short-term volatility in migration and property markets. This report unpacks five key insights into migration and the housing market.

1. Housing tenure of migrants skew to rentals in the short term

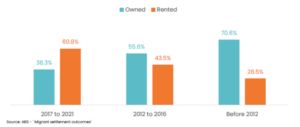

Fluctuations in overseas migration most immediately impact the rental market, rather than purchases. ABS data on permanent migrant settlement outcomes showed 60.8% of migrant arrivals in the five years to 2021 were renters. The incidence of home ownership was higher among permanent migrants who had been in the country for longer. As of 2021, this included 55.6% of arrivals between 2012 and 2016, and 70.6% of migrant arrivals before 2012 (figure 1).

Figure 1. Portion of permanent migrants renting or owning a dwelling, by year of arrival in Australia

For temporary migrants, 68.9% of temporary migrants 15 years and older were renters in 2021. This included 91.6% of temporary skilled visa holders, and 83.5% of student visa holders.

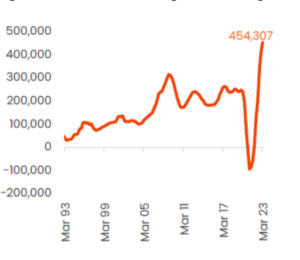

2. Part of the reason migration is so high right now is because it was temporarily restricted

Australia closed its borders to all non-citizens and non-residents in late March 2020, and fully re-opened to vaccinated and non-vaccinated arrivals in July 2022. By March 2023, Australia’s annual population growth hit 2.17%, the highest rate since 2008. Net overseas migration, which is overseas arrivals minus departures[1], is currently at record highs annually, at 454,000 added to the population in the past 12 months. The pre-COVID decade average of annual net overseas migration is 217,000.

Figure 2a.Net overseas migration, rolling annual, Australia

Figure 2b.Overseas arrivals and departures, rolling annual, Australia

Assuming the average household size of 2.49 people per dwelling in January this year, the year to March would have seen demand for around 182,000 additional dwellings, in a year when around 175,000 dwellings were completed. That’s not to mention new household formation domestically, as young Australians move out, buy first homes, or start their own families. Domestic household formation has increased substantially in recent years amid a reduction in average household size.

The high level of net overseas migration in the past year is partly a temporary result of the travel ban. It has been pushed higher by a concentrated number of overseas arrivals in a short space of time, and a 22% drop in departures compared to the historic five-year average. The decline in departures is explained by the ABS as a lagging result of fewer arrivals in recent years, which has translated to fewer departures a few years later. The record level of arrivals may in part be because of new, and postponed, decisions to come to Australia coalescing.

Without the ban, historic migration patterns suggest net overseas migration would probably be far closer to historic averages for the year to March 2023. Notably though, there has also still been fewer arrivals since COVID than we would have seen without travel restrictions. The strong spike in migration this year will normalise in time, and should not be an influence on long-term migration policies.

3. The COVID migration ban created volatility in rental markets

A temporary cap on migration may relieve housing demand in the short run, but COVID-19 has already demonstrated the longer-term issues with temporary migration caps. Because housing demand (the movement of people) is more liquid than housing supply (the construction or acquisition of new housing), the re-opening of international borders created a demand shock, which quickly pushed up rents and worsened an already tight rental market. The demand shock also came amid constraints to new available supply, as sellers were put off by rising interest rates, and new home completions were delayed by increased material costs and labour shortages.

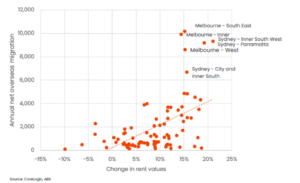

Historically, the SA4 regions with the highest volume of net overseas migration has been Melbourne’s South East and Inner SA4’s as well as Sydney’s Inner South West and Paramatta. Between July 2022 (when international travel restrictions eased) and October this year, these areas had among the strongest increases in rent values, averaging 18% growth in rents. Figure 3 shows the positive correlation between growth in rent values since July 2022, and historic volumes of net overseas migration by SA4 region. This reaffirms the upward pressure overseas migration has had on rents in the short term.

Figure 3. Change in rents since COVID travel restrictions eased in July 2022

Some markets with high exposure to overseas migration also saw a sharp drop in rent values at the onset of the pandemic. Between March 2020, when international borders were restricted, to July 2022 when restrictions were eased, Melbourne – Inner rent values rose just 1.1%. This is compared to a 16.4% increase in rents nationally. Since the pandemic overall, rent growth in the Melbourne – Inner market is 15.7%, which is actually far lower than the national figure of 28.4%.

Interestingly, longer term growth in rent values is actually far less correlated with overseas migration. Figure 4 compares the volume of net overseas migration by region with rent growth over the past five years. The graph shows the largest, longer-term increases in rents are in resource-based markets and Perth, which has also been subject to volatile economic conditions and housing demand. High overseas migration markets meanwhile, have had more moderate rental growth in the past five years of between 20% and 30%.

Figure 4. Change in rents, five years to October 2023

The reason high overseas migration markets have more moderate rent growth long term may be that the onset of COVID border closures saw a negative demand shock to these markets initially. Secondly, high overseas migration markets have attracted some of the highest concentrations of new, high density development over time, making rent growth relatively low over a longer period. Capping migration to Australia could reduce incentives for investment housing in these markets longer term, which again could create a demand shock if those caps are lifted.

4. Migration is not the only demand-side factor pushing up housing costs

A sharp reduction in the number of people per household early in the pandemic added to dwelling demand by around 120,000 households, largely while border restrictions were in place. This was also likely enabled by higher household income from government stimulus and low interest rates, which incentivised people to spend on larger homes.

Longer term, other factors have contributed to smaller household size on average, such as the aging population and falling marriage rates. Private rental market demand has also increased over the decades with falling rates of home ownership and a declining portion of social housing within the housing stock. The role of these other factors became evident between March 2020 and July 2022, when international borders were largely closed to overseas arrivals, and rents over that time rose 16.4% nationally.

5. Reducing the migration intake would have trade-offs

Australia currently has a largely uncapped temporary visa program, and imposing long-term targets on temporary and permanent migrants could allow better planning for infrastructure, housing and services. However, limiting temporary migration has economic trade-offs, and can be very complex to implement.

Higher levels of skilled migration may even help with aspects of the current housing shortages in Australia. The UK has recently relaxed visa rules to relieve shortages in the construction sector. The WA state government this year announced a grant of up to $10,000 for the settlement of skilled migrants in construction to boost dwelling completions. Recent overseas arrivals data from the ABS showed net overseas arrivals of skilled migrants hit around 71,000 in the year to August, which is well above long-term averages, and may help to boost the productive capacity of the economy, which is important in a high inflationary environment.

In summary, the high concentration of net overseas migration to Australia is adding to demand-side pressures on housing costs in the short term, particularly in some rental markets. However, a temporary cap on migration is not a good solution to easing demand-side pressures, because it introduces more volatility to the market. A consistent, longer-term target for migration could enable better planning of housing supply, but will have trade-offs for economic growth. Migration can also be strategic to ensure a more productive labour force, including for the delivery of housing and infrastructure. Domestically, other policies could be considered to ease the imbalance between housing supply and demand, such as incentivising more efficient use of existing housing stock.

Source: corelogic.com.au