Homeowners are holding onto properties for longer than ever, with new research revealing the suburbs where people buy and stay put for decades.

Analysis of PropTrack data shows that the average period of ownership of a property has lengthened to about 11 years at the national level, increasing by 23% over the past 10 years.

But in some suburbs, holding periods have grown to more than double the national average, with infrastructure improvements, demographic changes or entrenched communities giving homeowners few reasons to leave.

With owners retaining properties for longer, options have become increasingly limited for buyers hoping to get a foothold in suburbs so desirable that people rarely sell.

Use the interactive below to see how tightly held your suburb is.

“Across Australia, there are many suburbs that homeowners buy into, fall in love with, and then never want to leave,” said PropTrack economist Anne Flaherty.

“The most tightly held suburbs tend to be those that appeal to a wide range of different people, from young families to retirees, and are often located in the middle and outer suburban rings.”

“They tend to have excellent amenity, such as schools and shops, as well as lifestyle attributes such as parks or being close by the water. Many also benefit from being well serviced by road and rail networks which enable access to cities and employment hubs.”

“For buyers looking to move into these tightly held suburbs, opportunities are scarce, and there’s often high levels of competition.”

Australia’s most tightly held suburb is Clarinda, in Melbourne’s south east, where properties are owned for about 24 years on average.

“A lot of people have been there since the 1980s when the majority of the homes were built,” said local real estate agent Peter Laspas of Buxton Oakleigh.

“It’s such a convenient area compared to some other areas further out. There’s good shops, amenities and three primary schools to choose from. It’s a very good area to raise a family.”

Clarinda in south east Melbourne is Australia’s most tightly held suburb. This three bedroom house sold last year after being owned for almost 21 years. Picture:realestate.com.au/sold

While most homeowners in Clarinda tended to be older, Mr Laspas said younger buyers priced out of surrounding suburbs were drawn to the suburb’s relative affordability and value for money.

“Most are first-home buyers looking to get into the market, but we’ve also seen people who grew up in Clarinda, moved out, got married and are moving back into the area to start their families,” he said.

“It is very hard to get into the market because of the lack of supply. Whenever something does come up, it’s very hotly contested.”

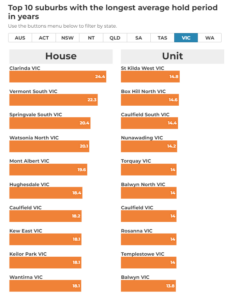

Victoria’s longest average hold period in years

Source: PropTrack • Average hold period of properties sold in the past 12 months. Calculated using a minimum of 15 sales.

Sydney’s most tightly held suburb for all dwellings is St John’s Park, about 35 kilometres west of the CBD, with the fourth longest average holding period in the country at almost 20 years.

“It’s a bit of a sleeper,” said local real estate agent Blaz Dejanovic of Blaze Real Estate. “It’s a small suburb, with not much turnover. It’s in very high demand right now.”

The demographic in St Johns Park is slightly older than the national median, and most buyers were established families, Mr Dejanovic said, many of whom were drawn to the area’s Vietnamese community.

“There’s not too many investors, so the number of owner occupiers is higher than tenants,” he said.

An older median age and a high proportion of owner occupiers are characteristics that are common among the most tightly held suburbs.

“The suburbs with the longest hold times tend to be more dominated by owner occupiers,” Ms Flaherty said. “They tend to be those family-friendly suburbs.”

Properties in these suburbs tend to be freestanding houses, often originally built between the 1950s and 1990s. Picture Ramsay Street from TV soap opera Neighbours — filmed on location in Australia’s second most tightly-held suburb, Vermont South in Melbourne — and you’ll get the idea.

Duplexes and low-rise or medium density unit complexes such as townhouses or villas are also common.

This five bedroom home in Vermont South recently sold after being held for 28 years. Picture: realestate.com.au/sold

“Generally, units turn over more quickly than houses, but in some suburbs, this isn’t always the case,” Ms Flaherty said.

Cremorne Point and Kirribilli, waterfront suburbs on Sydney Harbour, are the suburbs with Australia’s longest hold times for units, at about 17 and 16 years respectively.

When it comes to units, proximity to water is another feature common among many tightly held suburbs. St Kilda West is the tightest held suburb for units in Melbourne, while Brighton has Adelaide’s longest average hold time and Minyama on the Sunshine Coast tops the list in Queensland.

Perth’s most tightly held suburb, Shelley, on the Canning River, is 29th in Australia overall and 6th for units. Houses there are held for about 18 years, and units, most of which are villas, for nearly 17 years on average.

With views like this, it’s no wonder Cremorne Point is the most tightly held suburb in Australia for units. This recently sold apartment was held for more than 30 years. Picture: realestate.com.au/sold

Well-regarded schools, particularly high schools, can also draw family buyers and entrench them in the local community.

Mansfield is Brisbane’s most tightly held suburb overall and 34th in Australia, with an average holding time of about 17 years, a period that has increased 63% over the past decade.

Real estate agent Damian Cochrane of Torres Property Coorparoo says the local high school draws buyers to the area, while the suburb’s position keeps them there.

“People are getting in a year or two before their kids go to high school,” he said. “Once the kids have finished school, it’s a convenient location, with easy proximity to the motorway and coast, fantastic public transport and lots of amenity.”

“It’s a suburb where you really don’t need to move unless you want a sea change”

Why are the tightest-held suburbs mostly in Sydney and Melbourne?

Suburbs with the longest hold times tend to be found in Sydney and Melbourne, where properties are held for an average of about 12 years, slightly longer than the national average.

“Sydney and Melbourne are where the bulk of employment is in Australia, so the populations are often less transient, particularly when you go to the middle and outer suburban areas,” Ms Flaherty said.

The high burden of stamp duty in Sydney and Melbourne — Australia’s two most expensive property markets — further discourages homeowners from selling and buying often.

“The higher property prices move, the more of a burden stamp duty becomes,” Ms Flaherty said.

“There are many people who may do the maths and work out that if they were to sell their property and purchase another property, they would be forking out an enormous amount in stamp duty to purchase that new property.”

The suburbs where properties change hands the quickest

Brighton, in the outer suburbs of Hobart, has the shortest average holding period in the country at just under five years.

Like many suburbs with short hold times, significant development has taken place in Brighton the past few years, with hundreds of new houses built on greenfield land bringing down the suburb average.

Pimpama and Maudsland, outer suburbs of the Gold Coast, as well as Officer in Melbourne’s outer east also had shorter average hold periods, owing to large numbers of brand new homes built in recent years.

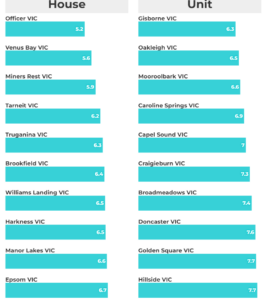

Victoria’s shortest average hold period in years

Source: PropTrack • Average hold period of properties sold in the past 12 months. Calculated using a minimum of 15 sales.

“In contrast to the most tightly held suburbs, the areas that see the fastest turnover of properties tend to be in newly established suburbs and regional areas,” Ms Flaherty said.

Shorter holding periods in newly developed areas not only reflects the age of housing stock, but also the type of buyers an area attracts.

“In newly established suburbs, a lot of the buyers tend to be first-home buyers,” Ms Flaherty said. “Often people don’t stay in their first home forever. They’ll buy their first home in an area they can afford, and their subsequent home might then be their forever home.”

New housing dominates many suburbs with the shortest holding periods, such as Maudsland, where this recently sold home was built by former Block contestants Ayden and Jess three years ago. Picture: realestate.com.au/sold

Suburbs with large scale apartment development, such as Rhodes and Zetland in Sydney, and Newstead in Brisbane also had shorter average hold periods for units, given much of the housing stock has only existed for a few years, not decades.

In regional areas, many suburbs with short holding periods were in areas with a high proportion of quick property resales. In some regions, more than a quarter of properties listed for sale in the first half of 2023 were held for less than three years.

Significant value uplift since the onset of the pandemic, driven by increased demand from treechangers, has prompted some owners to sell and upgrade quickly, while others were motivated to sell by rising interest rates or a desire to return to the city.

Why people are now staying put for longer

Holding periods in some suburbs have increased significantly in the past decade, usually as a result of improvements to infrastructure and amenity in the area.

“Better infrastructure is really key,” Ms Flaherty said. “If we look at the suburbs that are seeing the longest hold times they tend to be very well connected, they’ve got good road networks, good public transport, lots of shopping precincts, entertainment precincts, and lots of schools.

“Whereas in many of these newly developed areas, particularly urban fringe and regional areas, there tends to be significantly less infrastructure in comparison to metropolitan areas, so there’s more keeping people in place in the metro areas.”

Hold times have increased significantly in suburbs such as Emerton, Willmot, Lethbridge Park and Blackett, which were once on the periphery of western Sydney’s urban sprawl but have since become surrounded by newer suburbs.

“The infrastructure around western Sydney has got better and people now enjoy living here more,” said Roy Amery of Richardson & Wrench Rooty Hill and Mount Druitt. “There’s easier access to the city and Parramatta with the M7 motorway, better schools, and it’s just picked up.”

Previously, local buyers tended to be investors targeting affordable properties and high rental yields, Mr Amery said, many who still retained properties after significant capital gains. But more owner-occupier families were finding appeal in the area.

“People are even doing knock down rebuilds and that wasn’t really happening 10 years ago,” he said.

Infrastructure improvements, such as new motorways, public transport or shopping centres, can enhance the liveability of a suburb, prompting people to stay for longer. Picture: Getty

In Clarinda, rehabilitation of former landfill sites has created new parklands, improving local amenity as well as the suburb’s reputation, Mr Laspas said. “The old stigma of the Clarinda tips has definitely gone away.”

More broadly, rising property prices have prompted some first-home buyers to hold onto properties for longer, especially apartments, Ms Flaherty said.

“In the past people would purchase a unit as their first home, then down the track they would upgrade to a house when they were entering that next phase of their lives where potentially, they want to start families.”

“What we have seen, particularly in Sydney and Melbourne, is that the cost of housing has increased so much that it’s led to a rethink of what the family home looks like.”

“Because we have seen much bigger growth in houses compared to units over the past few years, first-home buyers who may have planned to upgrade to a larger dwelling may not be able to afford to do so, so are staying longer in their first home.”

A growing gap between house and unit prices has meant some first-home buyers are living in apartments for longer and delaying upsizing. Picture: Getty

In tightly held areas, government incentives such as tax exempt super contributions may not be sufficient to encourage older home owners to downsize, Ms Flaherty said, which could otherwise help free up housing stock.

“The amount you can put into your super doesn’t even come close to the median price of a property in Sydney or Melbourne.”

“Many people may look at that incentive and think it’s not enough, and hold onto their property as a store of wealth, then pass on that property to their children.”

The trend towards longer hold times can further be explained by the trajectory of home values, Ms Flaherty said, with people holding onto properties longer with the expectation of further capital growth.

“If we look at the long term history of property prices in Australia, even though we do see fluctuations over time, the broad theme is that prices increase, particularly for houses.”

“There may be a lot of people who say: ‘Why would I sell, when I know the longer I hold onto this asset, the more it will increase over time?’”

Source: realestate.com.au