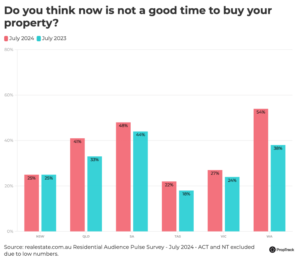

New data has revealed there are more buyers concerned that now is not a good time to purchase a property compared to last year.

In the most recent Residential Audience Pulse survey conducted by realestate.com.au in July, 34% believed that now was a bad time to buy, compared to 29% last year.

Since the last survey in April, the number of non-confident buyers increased by 35%, despite buyer activity being unseasonably strong throughout the winter months.

The largest uncertainty was seen in Western Australia and Queensland, where the number of respondents who considered now a bad time to buy was at 54% and 41%, respectively.

For WA, this was an increase of 43% compared to last year, and 26% for QLD.

Although most states saw an increase in the number of less confident buyers, with the exception of New South Wales, where the percentage remained unchanged, there was also an increase in buyers who felt now was a good time to purchase.

NSW, Victoria, South Australia, and Tasmania all saw an increase in the number of potential buyers who thought now was an opportune time.

In VIC, there was a 14% increase in positive buyers, and in SA there was a 28% increase.

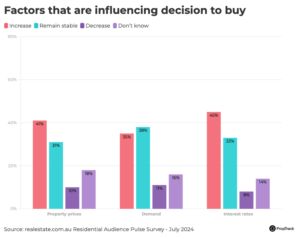

There are a number of factors influencing buyer sentiment in the current climate, such as property prices, demand and interest rates.

There are more homebuyers concerned that now is not a good time to purchase a property compared to last year. Picture: Getty

There was a 46% increase in the number of potential buyers who think that prices will continue to rise in the next six months and as a result may be concerned about being able to afford to buy.

In WA and QLD, which have both experienced double-digit price growth, the majority of survey respondents believe that prices will continue to rise. In both states this was a double-digit increase compared to last year.

This sentiment was similar in NSW and VIC; however, Tasmania bucked the trend with 55% of respondents thinking prices would remain stable.

The largest concern for buyers was the possibility of future interest rate rises.

In recent months, there has been talk of more rate rises, if inflation is not contained, and this is weighing on the minds of property seekers.

Forty-five percent of respondents thought interest rates would rise again in the next six months, more than double the number in the previous survey.

Finally, buyers also thought that demand for properties was likely to increase or remain stable in the next six months.

These survey results are in stark contrast to the responses provided by potential sellers, who were very optimistic that now was a good time to sell.

High prices and increased demand have created a perfect environment for sellers, but the same high prices and the fear of future interest rate rises have made buyers more apprehensive about purchasing at this time.

Source: realestate.com.au